When homeowners question a valuation, asking for a second opinion on a home appraisal in Eagle Idaho can feel uncomfortable. However, it is far more common than most people realize. Appraisals influence selling strategies, refinancing options, and purchasing power. Therefore, understanding when and why to seek another professional perspective can protect your equity and your peace of mind. In a nuanced market like Eagle Idaho, small valuation discrepancies can translate into tens of thousands of dollars, especially when inventory tightens or buyer demand surges.

Why do home appraisals matter so much in Eagle Idaho?

Appraisals are the financial fulcrum of nearly every real estate transaction. Lenders rely on them to confirm risk, buyers depend on them for reassurance, and sellers view them as validation of years of investment. In Eagle Idaho real estate, appraisals can be especially influential due to diverse neighborhoods, custom homes, and fluctuating demand from those moving to Idaho.

However, appraisals are not infallible. They are professional opinions based on recent comparable sales, property condition, and market trends. Consequently, when data is thin or neighborhoods vary block by block, even experienced appraisers may undervalue or overvalue a property. Meanwhile, sellers and buyers are often left wondering whether the number truly reflects the market.

When should you consider a second opinion on a home appraisal?

Not every appraisal requires a challenge. Still, certain scenarios justify a closer look. For example, if an appraisal comes in significantly lower than expected without clear justification, requesting a second opinion on a home appraisal in Eagle Idaho may be prudent. Similarly, errors in square footage, bedroom count, or upgrades can materially affect value.

Additionally, rapidly appreciating areas often lag in appraisal data. Therefore, if your home sits in one of the best neighborhood in Eagle and recent sales fail to capture current demand, a second appraisal can help recalibrate expectations. Ultimately, timing, accuracy, and market velocity all matter.

Are appraisals ever wrong or outdated?

In fact, appraisals are snapshots in time. They rely on closed sales, not pending contracts or buyer competition. Consequently, in a fast-moving Boise Idaho and Eagle ID market, values may rise faster than appraisal reports reflect.

Moreover, appraisers unfamiliar with Eagle Idaho neighborhoods may miss subtle distinctions between subdivisions, school zones, or proximity to amenities. Therefore, while appraisers are licensed professionals, local insight plays a pivotal role. According to the National Association of Realtors, valuation disputes are among the most common transaction hurdles nationwide, particularly in low-inventory markets.

How does a second appraisal work during a sale?

During a sale, a second appraisal typically comes into play when the initial valuation jeopardizes financing. Lenders may allow a reconsideration of value if factual errors exist or if stronger comparable sales can be presented. However, lenders rarely order an entirely new appraisal unless justified.

This is where working with a top realtor in Eagle becomes essential. A seasoned Eagle Idaho realtor can compile market data, highlight overlooked upgrades, and present a compelling case. Meanwhile, sellers gain clarity and buyers gain confidence in the transaction’s fairness.

Can buyers benefit from a second appraisal too?

Buyers are not immune to appraisal concerns. For instance, an inflated appraisal can expose buyers to overpaying. Conversely, a low appraisal may require renegotiation or additional cash at closing. Therefore, buyers should understand appraisal methodology and local pricing norms.

When buying a home in Eagle, having an advocate who understands appraisal nuances can prevent costly mistakes. Moreover, buyers relocating from out of state often benefit from local expertise when navigating Eagle Idaho homes for sale in Eagle Idaho.

What role does the local market play in appraisal accuracy?

Local market dynamics shape appraisal outcomes more than many realize. Eagle ID features a blend of luxury estates, suburban neighborhoods, and semi-rural properties. Consequently, comparable sales may vary widely even within short distances.

Additionally, factors like property taxes, school districts, and infrastructure improvements influence value. Data from the City of Eagle, ID shows ongoing community development, which can enhance desirability and future appreciation. Therefore, appraisals that fail to account for these variables may undervalue homes.

How can a local real estate expert help challenge an appraisal?

A local professional brings context. By analyzing recent sales, active listings, and buyer behavior, an experienced agent can identify discrepancies. Moreover, presenting upgrades, energy-efficient features, or premium lot attributes can strengthen a reconsideration request.

Working with the best realtor in Eagle ID ensures that appraisal challenges are handled professionally and persuasively. For example, documentation, photographs, and market analysis can be assembled to support a revised valuation. Ultimately, expertise and preparation often make the difference.

Is refinancing a common reason for second appraisals?

Yes, refinancing frequently prompts appraisal scrutiny. Homeowners seeking better rates or cash-out options depend on accurate valuations. However, if an appraisal undervalues the home, refinancing terms may suffer.

Therefore, homeowners considering a refinance should understand their home’s market position. Reviewing comparable sales and understanding Eagle Idaho real estate trends can inform whether a second opinion is warranted. Meanwhile, consulting an Eagle ID realtor provides clarity before making lender requests.

What risks come with disputing an appraisal?

Challenging an appraisal is not without risk. Lenders may deny reconsideration requests, and delays can occur. However, when discrepancies are factual or market-driven, the potential upside often outweighs the inconvenience.

Importantly, disputes should remain professional and data-driven. Emotional appeals rarely succeed. Instead, clear evidence and local market insight carry weight. Consequently, homeowners benefit from guidance throughout the process.

How does Eagle compare to Boise in appraisal sensitivity?

Eagle and Boise share proximity yet differ in composition. Boise ID often has more uniform housing stock, while Eagle features greater variation in home style and lot size. Therefore, appraisals in Eagle may require deeper analysis.

Additionally, demand patterns differ. Eagle Idaho neighborhoods often attract move-up buyers and retirees, influencing price stability. Understanding these distinctions helps contextualize appraisal outcomes and reinforces the value of local expertise.

Can a second appraisal increase my home’s value?

A second appraisal does not magically increase value. However, it can correct inaccuracies and better reflect current conditions. When successful, it aligns valuation with market reality.

For homeowners preparing to sell your home, accurate pricing is essential. Overpricing deters buyers, while underpricing sacrifices equity. Therefore, appraisal accuracy underpins strategic decision-making.

How does this affect long-term equity and planning?

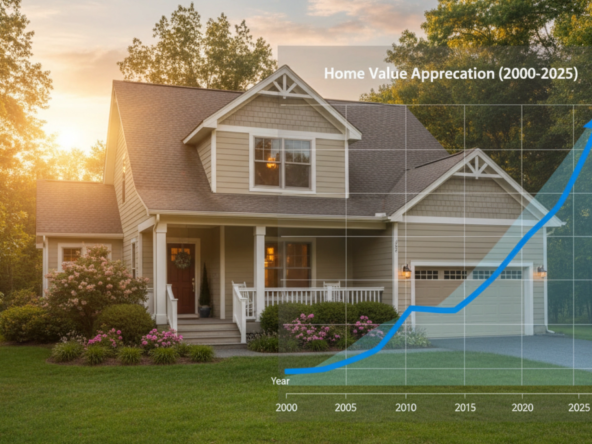

Equity influences wealth planning, relocation options, and retirement strategies. Consequently, ensuring accurate valuations protects long-term financial health. In Eagle Idaho, where property values have shown resilience, maintaining clarity around home value is critical.

Moreover, for families moving to Idaho, understanding valuation norms reduces surprises and builds confidence in long-term investments.

What should homeowners do before requesting a second opinion?

Preparation matters. Gather recent comparable sales, document upgrades, and review the appraisal for errors. Additionally, consult a trusted local professional for perspective.

Engaging Chris Budka Real Estate provides homeowners with market insight and advocacy. With experience across Eagle Idaho real estate, strategic guidance ensures informed decisions rather than reactive ones.

Is a second opinion right for every homeowner?

Not always. Some appraisals are accurate and defensible. However, when questions arise, seeking clarity is reasonable. Ultimately, knowledge empowers homeowners to act confidently.

By understanding when and how to pursue a second opinion on a home appraisal in Eagle Idaho, homeowners protect their interests and navigate transactions with assurance.

FAQs

Should I always challenge a low appraisal?

Not necessarily. However, if errors or outdated data exist, a professional review may be worthwhile.

How long does the appraisal reconsideration process take?

Timelines vary, although most lenders respond within one to two weeks.

Can sellers order their own appraisal?

Yes, sellers may order independent appraisals, although lenders rely on their own reports.

Does a second appraisal guarantee a higher value?

No guarantee exists. However, it can correct inaccuracies and reflect market conditions more accurately.

How can Chris Budka Real Estate help with appraisal concerns?

By providing local market analysis, documentation, and strategic guidance, Chris Budka Real Estate supports informed decisions throughout the process.

Bottomline

Ultimately, seeking a second opinion on a home appraisal in Eagle Idaho is about clarity, confidence, and protecting equity. When valuations raise questions, informed action supported by local expertise ensures homeowners make decisions rooted in market reality rather than uncertainty.