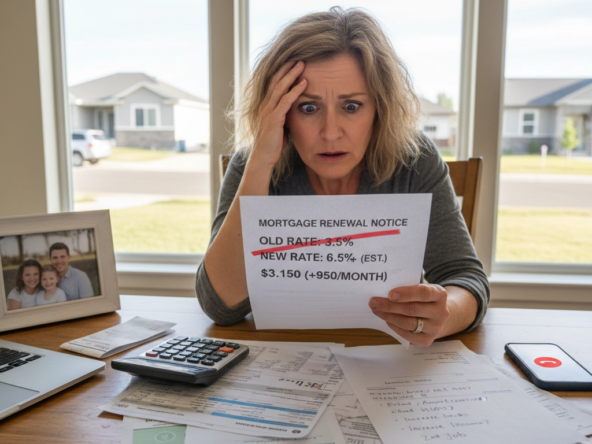

Mortgage rates continue to dominate conversations in Eagle Idaho real estate, leaving many buyers wondering: Can I still afford a home in Eagle Idaho if rates don’t drop? The answer is yes, but it requires understanding local trends, leveraging financing options, and prioritizing long-term value over short-term fluctuations. In fact, buyers who approach the market strategically often find opportunities that make ownership attainable despite higher rates.

Understanding Today’s Mortgage Rate Reality

While mortgage rates may remain elevated, homeownership is far from impossible. Buyers must focus on controllable factors like down payment, property choice, and negotiation strategy. In Boise Idaho and the surrounding Treasure Valley, inventories are improving, creating subtle leverage for those prepared to act. Consequently, understanding the local market is more crucial than chasing rate predictions.

How Affordability Really Works in Eagle

Affordability extends beyond monthly mortgage payments. It includes property taxes, insurance, energy efficiency, and potential appreciation. Eagle ID homes often feature energy-efficient designs that reduce utility costs, while property taxes remain lower than the national average according to the Idaho State Tax Commission. Moreover, Eagle Idaho real estate has historically appreciated steadily, making it a sound long-term investment.

Why Waiting for Lower Rates Can Cost More

Waiting for rates to drop carries hidden risks. Home prices often rise as rates fluctuate, potentially negating any savings. Meanwhile, renting in the Treasure Valley continues to escalate, offering no equity growth. Buyers who purchase now retain the flexibility to refinance later if rates improve, a strategy often referred to as “marry the house, date the rate.”

Creative Financing Options That Improve Affordability

Several financing strategies can make buying feasible. Adjustable-rate mortgages, temporary buydowns, and seller concessions are increasingly common. Veterans can leverage VA loans for zero down payments, while first-time buyers may access specialized programs. For instance, seller-paid buydowns reduce initial interest payments, easing the financial transition.

The Importance of Local Market Knowledge

National headlines often overlook micro-market differences. In Eagle Idaho neighborhoods, limited land availability and high quality of life sustain demand. Working with a seasoned Eagle Idaho realtor uncovers homes priced below replacement cost or overlooked due to marketing gaps, giving buyers a competitive advantage.

Choosing the Right Home Type

Selecting the right property type is critical. Single-level homes, townhomes, and smaller-lot properties often provide more accessible entry points. Best neighborhoods in Eagle may have premium pricing, but smaller properties allow buyers to enter the market while still benefiting from strong long-term value. Compromising on size or finishes often pays off through future appreciation.

Long-Term Equity vs. Short-Term Rate Anxiety

While mortgage rates fluctuate, real estate equity grows steadily. The National Association of Realtors shows that homeownership remains one of the most reliable wealth-building tools. Additionally, locking in housing costs protects against inflation, offering financial stability that rent payments cannot.

How Relocation Buyers Are Making It Work

Many families moving to Idaho from higher-cost regions bring equity that offsets higher rates. Even local buyers can benefit by leveraging down payment assistance or home equity. Population growth in the Treasure Valley, as highlighted by the U.S. Census Bureau, supports long-term housing demand and value.

Negotiation Is Back on the Table

Today’s buyers have more negotiating power. Seller concessions, closing cost credits, and flexible timelines are increasingly available. Negotiating repairs or credits preserves cash reserves, particularly important for first-time buyers. Working with a top realtor in Eagle ensures buyers maximize these opportunities.

Exploring Homes for Sale in Eagle Idaho

Searching for homes for sale in Eagle Idaho reveals a broader price range than many expect. While luxury homes often dominate headlines, many Eagle ID homes for sale remain attainable with the right strategy. Partnering with Chris Budka Real Estate provides insights, off-market access, and data-driven guidance, resulting in better outcomes.

When Buying Still Makes Sense

Buying remains sensible when monthly payments fit your budget and long-term goals. It’s also advantageous for lifestyle, stability, and community. Eagle Idaho offers all three. Affordability is personal, shaped by income, priorities, and planning. Rates are just one factor—not a barrier.

FAQs

Can I still afford a home in Eagle Idaho if rates don’t drop?

Yes. With proper planning, creative financing, and strategic negotiation, most buyers can still afford a home. Rates are only part of the affordability equation.

Is it better to wait for rates to drop before buying?

Not always. Waiting can lead to higher home prices and rent payments. Buying now allows you to secure a home while preserving the option to refinance if rates improve.

Are there affordable neighborhoods in Eagle?

Yes. Several Eagle Idaho neighborhoods offer strong value, including townhomes and smaller-lot options. Local expertise is key to identifying these opportunities.

How does working with a top realtor in Eagle help affordability?

A top realtor in Eagle provides market insight, identifies negotiation opportunities, and uncovers off-market homes, directly impacting your affordability.

What if I’m relocating from out of state?

Buyers moving to Idaho often benefit from equity transfer, lower property taxes, and local market knowledge to maximize value and affordability.

Bottomline / Conclusion

Mortgage rates may not drop further, but homeownership in Eagle Idaho is still achievable. Affordability depends on strategy, local expertise, and flexibility. With guidance from a best realtor in Eagle ID, buyers can confidently navigate Eagle Idaho real estate, secure the right home, and build long-term wealth.