VA loans for zero-down buying in Eagle Idaho 2026 are creating powerful opportunities for veterans and active-duty families who want to plant roots in one of the Treasure Valley’s most desirable communities. In fact, with rising home values across Eagle Idaho and the greater Boise Idaho metro, preserving cash while securing a competitive mortgage has never been more important. Therefore, understanding how VA financing works in today’s market can give you a decisive edge.

As a trusted top realtor in Eagle, Chris Budka helps military families navigate every step of the homebuying journey with clarity and confidence. Meanwhile, the goal remains simple: maximize your benefits while minimizing out-of-pocket expenses.

What Makes VA Loans Different in 2026?

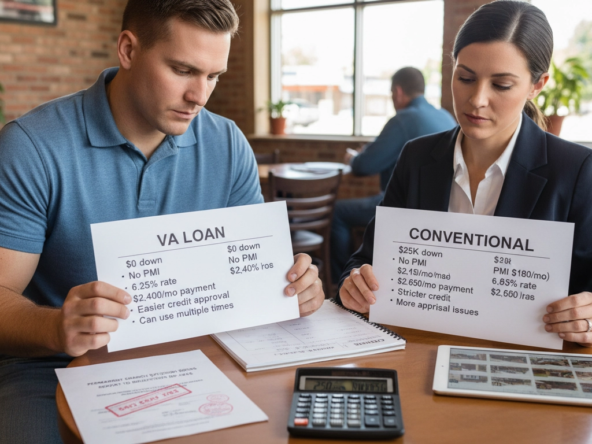

VA loans are backed by the U.S. Department of Veterans Affairs, which means lenders assume less risk. Consequently, qualified buyers can purchase a home with zero down payment and no private mortgage insurance. That advantage alone can save hundreds per month.

Unlike conventional financing, VA loans are designed specifically for those who have served. Additionally, underwriting guidelines are often more flexible. For example, credit score requirements are typically more forgiving than traditional loan programs.

In 2026, VA loan limits in most Idaho counties allow eligible buyers with full entitlement to purchase without a cap tied to county loan limits. However, lender approval and appraisal value still matter. Therefore, working with an experienced Eagle ID realtor is essential.

How Zero Down Actually Works in Eagle Idaho

Zero down does not mean zero cost. Instead, it means you are financing 100% of the home’s purchase price—assuming the property appraises at or above contract value.

Here’s how VA loans for zero-down buying in Eagle Idaho 2026 typically function:

• The lender approves you based on income, credit, and debt ratios.

• The VA guarantees a portion of the loan.

• You purchase without a down payment.

• You avoid monthly mortgage insurance.

Meanwhile, you will still pay closing costs, prepaid taxes, and insurance. However, sellers in Eagle Idaho sometimes contribute toward those costs, especially in balanced market conditions.

If you’re exploring current homes for sale in Eagle Idaho, a VA structure can preserve liquidity for moving expenses or upgrades.

Understanding the VA Funding Fee

Although VA loans eliminate PMI, they include a one-time funding fee. This fee sustains the program long-term. In 2026, first-time users putting zero down typically pay 2.15% of the loan amount.

For example, on a $600,000 Eagle ID home, the funding fee would be $12,900. However, you can roll that into the loan instead of paying it upfront.

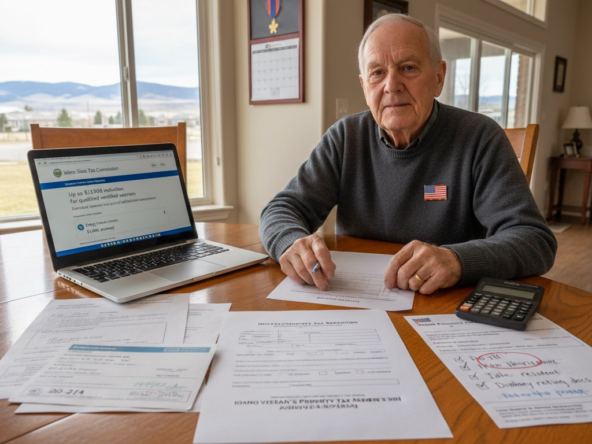

Some veterans are exempt. According to the U.S. Department of Veterans Affairs, veterans receiving disability compensation may not pay the fee at all.

Therefore, reviewing your Certificate of Eligibility early is critical.

Why VA Loans Are Powerful in Eagle Idaho Real Estate

Eagle Idaho real estate remains highly desirable due to its scenic foothills, equestrian estates, and riverfront properties. Additionally, proximity to downtown Boise Idaho makes it ideal for professionals who commute but prefer suburban serenity.

According to the U.S. Census Bureau, Eagle Idaho continues to experience population growth. Consequently, demand remains steady.

VA loans for zero-down buying in Eagle Idaho 2026 allow qualified buyers to compete in neighborhoods such as:

• Banbury Meadows

• Legacy

• Two Rivers

• Brookwood

If you’re researching the best neighborhood in Eagle, understanding HOA structures, property taxes, and resale trends is equally important.

Appraisals and Property Standards

The VA appraisal protects buyers. Unlike a standard appraisal, it includes minimum property requirements. Therefore, homes must be safe, structurally sound, and sanitary.

In Eagle Idaho, most newer builds meet these guidelines easily. However, rural properties or older homes may require minor repairs before closing.

Additionally, if the appraisal comes in below purchase price, you may need to renegotiate or pay the difference. This is why strategic offer structuring matters.

Working with the best realtor in Eagle ID ensures you submit competitive yet protected offers.

Credit and Income Requirements

While the VA does not set a minimum credit score, most lenders prefer 620 or higher. Meanwhile, stable employment and manageable debt ratios are equally important.

VA underwriting also evaluates residual income. In other words, lenders calculate how much money remains after paying monthly obligations. Consequently, this adds an additional layer of financial prudence.

If you’re planning on moving to Idaho, preparing documentation early streamlines approval.

Using VA Loans for Higher-Priced Eagle ID Homes

Eagle ID homes often exceed state median prices. However, VA loans can still work beautifully in higher price brackets.

Because VA loans do not impose monthly mortgage insurance, your effective payment may rival conventional financing—even with zero down. Therefore, veterans purchasing executive homes or acreage properties often find VA loans surprisingly competitive.

Exploring current Eagle ID homes for sale reveals opportunities across luxury and entry-level segments alike.

Competing in a Competitive Market

The Treasure Valley market remains dynamic. Meanwhile, strong schools and outdoor recreation continue attracting relocation buyers.

According to the National Association of Realtors, VA loans have one of the lowest foreclosure rates among major loan types. Consequently, sellers often gain confidence when working with experienced VA buyers.

Structuring a strong earnest money deposit, securing pre-approval, and shortening contingency timelines can strengthen your offer.

How Chris Budka Real Estate Supports Veterans

At Chris Budka Real Estate, the focus is personalized guidance. Every transaction receives meticulous attention.

First, we connect you with reputable VA lenders. Next, we analyze pricing trends. Then, we craft a negotiation strategy tailored to your goals.

Whether you’re a first-time buyer, relocating officer, or downsizing retiree, clarity matters. Ultimately, VA loans for zero-down buying in Eagle Idaho 2026 become seamless with the right advocate.

Frequently Asked Questions

Can I buy a luxury home in Eagle Idaho with a VA loan?

Yes, provided you qualify financially and the home appraises at value. VA loans can be used for higher-priced Eagle ID homes if entitlement is sufficient.

Do sellers in Eagle Idaho accept VA loans?

Absolutely. Most sellers focus on price and strength of offer. Meanwhile, working with an experienced Eagle ID realtor ensures smooth communication.

How long does a VA loan take to close?

Typically 30–45 days. However, organized documentation and responsive communication can accelerate timelines.

Can I reuse my VA loan benefit?

Yes. VA benefits are reusable after selling or refinancing, depending on entitlement restoration.

Should I get pre-approved before shopping?

Without question. Pre-approval strengthens your negotiating power and clarifies budget parameters.

Bottom Line

VA loans for zero-down buying in Eagle Idaho 2026 offer a strategic pathway to homeownership without draining savings. Moreover, they provide competitive rates, eliminate PMI, and reward service with tangible financial advantages.

Eagle Idaho continues to stand out as one of the Treasure Valley’s most desirable communities. Therefore, aligning your VA benefit with local expertise creates a winning formula.

If you’re ready to explore Eagle Idaho homes or need guidance from a top realtor in Eagle, reach out today. The right strategy makes all the difference.