Relocating under PCS orders brings urgency, excitement, and a long checklist. If you’re weighing a VA loan vs conventional loan in Boise Idaho, you’re already making a smart move. Financing strategy matters—especially in a competitive Treasure Valley market. For military families moving to Idaho, understanding your options can save thousands over time and protect your financial flexibility.

Boise and Eagle continue to attract service members, veterans, and relocating families who want strong schools, safe communities, and proximity to outdoor recreation. However, choosing the right mortgage structure in this market is not a one-size-fits-all decision. Therefore, let’s break down what truly matters when comparing VA and conventional loans in the Boise area.

Why Military Families Are Choosing Eagle and Boise

The Treasure Valley offers a unique balance of livability and long-term appreciation. In fact, according to the U.S. Census Bureau, Boise has seen consistent population growth over the past decade. Meanwhile, nearby Eagle offers larger lot sizes, master-planned communities, and an elevated suburban atmosphere.

Many relocating buyers specifically search for Eagle Idaho real estate because of its reputation for safety and quality of life. The City of Eagle Official Website highlights the community’s parks, river access, and local events that make settling in seamless.

Additionally, military families often gravitate toward areas with strong resale potential. The National Association of Realtors consistently reports that lifestyle-driven markets like Boise Idaho remain resilient, even during market fluctuations.

Because of that, your financing choice must align with both short-term relocation needs and long-term equity growth.

Understanding the VA Loan Advantage in Boise

A VA loan is backed by the U.S. Department of Veterans Affairs and designed exclusively for eligible service members, veterans, and certain surviving spouses. Its benefits can be particularly powerful in a rising market like Boise.

First, VA loans typically require no down payment. That means buyers can preserve liquidity during relocation. Consequently, more funds remain available for moving costs, furnishings, or emergency reserves.

Second, there is no private mortgage insurance (PMI). Conventional loans often require PMI when putting less than 20% down. Over time, eliminating PMI can significantly lower your monthly payment.

Moreover, VA loans frequently offer competitive interest rates. While rates fluctuate based on economic conditions—tracked closely by sources like Freddie Mac—VA rates are often slightly lower than comparable conventional loans.

However, there is a VA funding fee. Although it can be financed into the loan, it’s important to compare total cost structures carefully.

When comparing a VA loan vs conventional loan in Boise Idaho, the VA option often wins for buyers prioritizing low upfront costs and monthly savings.

When a Conventional Loan Makes Sense

Conventional financing isn’t obsolete for military buyers. In certain scenarios, it can be advantageous.

For instance, if you’re planning to put 20% or more down, you can avoid PMI altogether. Additionally, buyers with excellent credit may secure competitive conventional rates.

Furthermore, conventional loans offer more flexibility on property conditions. VA appraisals require homes to meet specific habitability standards. If you’re considering a fixer-upper in an older Eagle Idaho neighborhood, conventional financing may provide more latitude.

According to Realtor.com, the Boise Idaho housing market includes both new construction and resale homes, some of which may need cosmetic updates. Therefore, understanding property condition requirements is essential.

In summary, if you’re equity-rich and purchasing a property that might not meet VA standards, conventional financing deserves consideration.

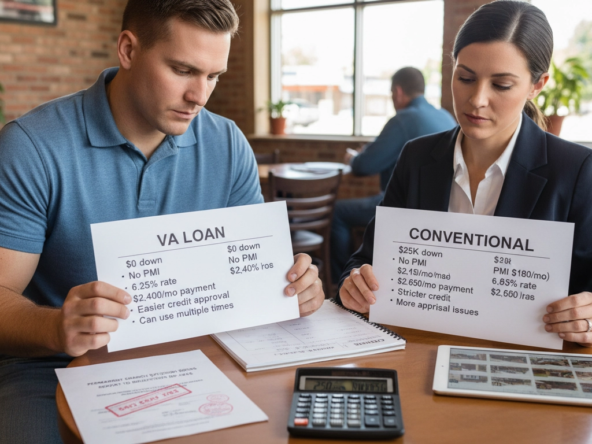

Cost Comparison: VA Loan vs Conventional Loan in Boise Idaho

Let’s look at a simplified example.

Imagine purchasing a $600,000 home in Eagle ID.

With a VA loan:

-

$0 down payment

-

No PMI

-

VA funding fee (financed)

With a conventional loan:

-

10% down = $60,000 upfront

-

PMI until 20% equity

-

No funding fee

While the conventional loan avoids the funding fee, the immediate cash requirement is significantly higher. For families relocating under orders, preserving $60,000 in liquidity can be strategically wise.

Additionally, if you anticipate another PCS in 3–5 years, minimizing upfront cash investment may improve overall financial flexibility.

Ultimately, analyzing your expected timeline in the home is crucial.

How the Boise Market Impacts Your Decision

Boise and Eagle remain competitive markets. As reported by BoiseDev, new developments and infrastructure projects continue to expand across Ada County. Consequently, inventory fluctuates seasonally, and well-priced homes move quickly.

In a competitive offer scenario, VA loans used to carry stigma. However, that perception has shifted. Today, sellers and listing agents in Eagle Idaho are far more accustomed to VA financing.

Working with a knowledgeable top realtor in Eagle ensures your offer is structured competitively, regardless of loan type.

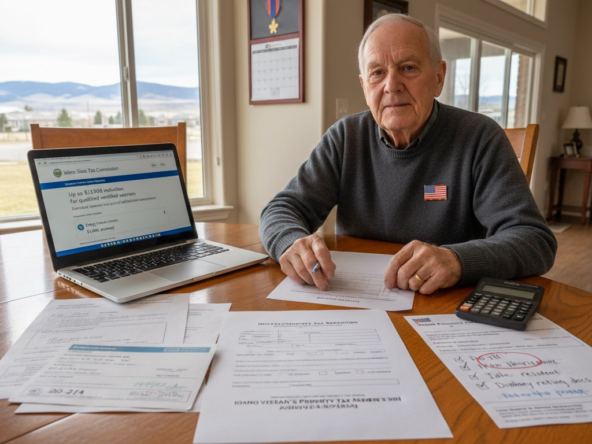

Additionally, understanding property taxes through the Idaho State Tax Commission helps calculate accurate monthly obligations before choosing financing.

Why Military Buyers Often Prefer VA in Eagle Idaho

When evaluating VA loan vs conventional loan in Boise Idaho, most military families lean toward VA for three reasons:

-

Lower upfront cost

-

No PMI

-

Flexible debt-to-income ratios

Furthermore, keeping savings intact can be especially important during relocation transitions. PCS moves bring unpredictable expenses. Therefore, financial cushion matters.

However, if you’re purchasing in a high-demand luxury segment within Eagle Idaho real estate, conventional financing with strong cash reserves can sometimes strengthen your offer.

That’s why strategic guidance matters.

Choosing the Right Strategy for Your Move

Every military move is unique. Some families plan to stay long term. Others expect reassignment within a few years.

If short-term ownership is likely, minimizing upfront investment through VA financing often makes sense. Meanwhile, long-term buyers focused on building equity aggressively may consider larger down payments under conventional terms.

Because the Treasure Valley market continues to evolve, timing also plays a role. Staying informed about market trends through reliable sources like the National Association of Home Builders provides additional context.

Above all, working with a trusted Eagle ID realtor who understands military relocation ensures no detail is overlooked.

The Role of a Local Expert in Military Relocation

Financing is only one piece of the puzzle. Selecting the right community is equally important.

Eagle Idaho offers waterfront properties, golf communities, and family-friendly subdivisions. Meanwhile, Boise Idaho provides urban convenience and proximity to downtown amenities.

Navigating homes for sale in Eagle Idaho requires local expertise and strategic timing. Moreover, identifying the best neighborhood in Eagle depends on commute, lifestyle, and school preferences.

An experienced professional who understands both financing dynamics and local inventory can help align your mortgage choice with your long-term goals.

For buyers evaluating VA loan vs conventional loan in Boise Idaho, clarity creates confidence.

Frequently Asked Questions

Is a VA loan always better for military buyers moving to Boise?

Not always. While VA loans offer zero down payment and no PMI, conventional loans can be advantageous for buyers with large down payments and excellent credit. Comparing total cost over your expected ownership period is essential.

Can I use a VA loan to buy in Eagle Idaho?

Yes. VA loans can be used for eligible primary residences in Eagle Idaho, provided the property meets VA appraisal standards.

How competitive are VA offers in the Boise market?

VA offers are widely accepted in today’s market. With proper structuring and guidance from a strong agent, they compete effectively against conventional financing.

What if I plan to move again in a few years?

If another PCS is likely, minimizing upfront cash through VA financing often makes financial sense. However, analyzing appreciation potential and rental rules is also important.

How can Chris Budka help with my military move?

Chris Budka provides tailored relocation guidance, neighborhood expertise, and strategic offer structuring. Whether you’re buying in Eagle or Boise, expert navigation simplifies the process.

Bottomline

When comparing a VA loan vs conventional loan in Boise Idaho, there is no universal winner. However, for many military families relocating to the Treasure Valley, VA financing offers meaningful advantages—especially lower upfront costs and no PMI.

At the same time, conventional loans remain viable for buyers with substantial equity and specific property goals.

The key is personalized strategy. Align your financing with your relocation timeline, savings goals, and neighborhood preferences.

With the right plan in place, your move to Eagle Idaho or Boise Idaho becomes not just a transition—but a powerful investment in your future.