Delayed financing for cash buyers in Eagle and Boise has become a powerful strategy in today’s competitive housing climate. In fast-moving markets like Boise Idaho and Eagle, buyers often need a decisive edge. Paying cash can secure that edge. However, tying up substantial capital in a home purchase isn’t always ideal. That’s where delayed financing steps in—allowing buyers to close with cash first and then refinance shortly after to restore liquidity.

For buyers navigating Eagle Idaho real estate, this strategy can be transformative. It combines the negotiating clout of a cash offer with the financial flexibility of a mortgage. Consequently, buyers gain leverage without sacrificing long-term financial agility.

Understanding Delayed Financing in Simple Terms

Delayed financing is essentially a specialized cash-out refinance. Instead of waiting six months to refinance after a cash purchase, buyers can apply for a mortgage almost immediately after closing. Therefore, the cash used to purchase the property can be recaptured and redeployed.

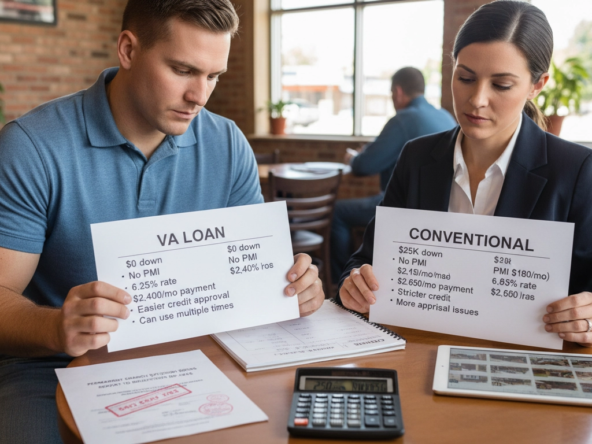

According to Fannie Mae, conventional loan guidelines permit delayed financing under specific conditions. For example, the home must have been purchased entirely with cash. Additionally, the buyer must document the source of funds used in the transaction.

In practical terms, you purchase the home outright. Meanwhile, you apply for a conventional or jumbo loan soon after closing. Once approved, the lender reimburses you up to the original purchase price, subject to loan-to-value limits. Ultimately, you’ve converted your all-cash purchase into a financed property—without losing time.

Why Cash Still Wins in Eagle and Boise

The Treasure Valley continues to attract families, retirees, and professionals moving to Idaho. In fact, the U.S. Census Bureau consistently ranks Idaho among the fastest-growing states. Growth fuels demand. Demand intensifies competition.

In multiple-offer scenarios, sellers often prioritize certainty over complexity. A cash offer eliminates financing contingencies. Consequently, closings move faster and feel more secure. Sellers in Eagle ID frequently select cash buyers even over slightly higher financed offers.

For buyers targeting homes for sale in Eagle Idaho, this advantage can be decisive. Furthermore, in luxury segments of Eagle ID homes, cash transactions are increasingly common. Therefore, delayed financing allows buyers to compete on equal footing.

How Delayed Financing Works Step-by-Step

First, you identify the right property in Eagle Idaho. Perhaps it’s in the best neighborhood in Eagle or a sought-after Eagle Idaho neighborhood near top schools and greenbelt access.

Next, you submit a cash offer. Once accepted, you close without a mortgage attached. The property title transfers free and clear.

After closing, you apply for a mortgage under delayed financing guidelines. The lender orders an appraisal and evaluates your credit, income, and assets. Meanwhile, you provide documentation showing where the original purchase funds came from.

Finally, the loan funds. The proceeds reimburse you for the purchase price, up to allowable limits. Consequently, your capital becomes liquid again, ready for investment, renovations, or diversification.

Who Benefits Most from Delayed Financing?

Relocating families often find this strategy compelling. When moving to Idaho from out of state, timing can be unpredictable. Selling a previous home, transferring employment, and coordinating logistics can be complex. Therefore, paying cash first removes financing delays.

Investors also leverage delayed financing. They purchase properties quickly, then refinance to free up capital for additional acquisitions. Meanwhile, they retain portfolio momentum.

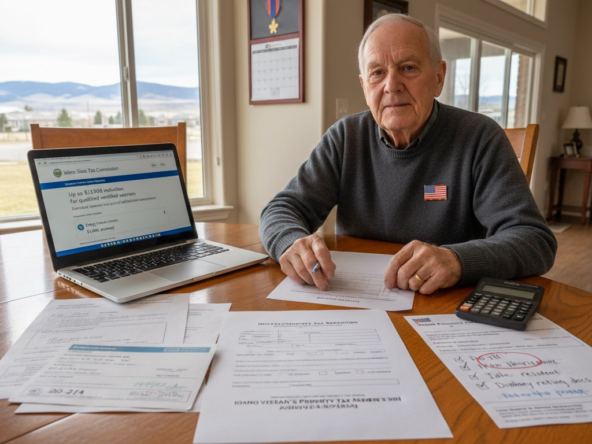

Retirees downsizing into Eagle ID homes for sale appreciate the flexibility. Instead of draining retirement accounts permanently, they can replenish liquidity soon after closing.

High-net-worth professionals, similarly, prefer keeping funds accessible for market opportunities. Ultimately, delayed financing aligns with strategic wealth management.

Requirements and Considerations

Not every transaction qualifies. According to Realtor.com, lenders require proof that the home was purchased entirely with cash. Gift funds or unsecured loans may complicate eligibility.

Additionally, the refinance loan amount typically cannot exceed the original purchase price. Even if property values increase immediately, lenders often cap proceeds at documented costs.

Loan-to-value ratios still apply. Credit scores, income stability, and debt-to-income ratios matter. Therefore, pre-planning with a lender is critical.

Mortgage rates also fluctuate. Checking current rate environments through sources like Freddie Mac provides helpful insight. Timing, consequently, plays a strategic role.

Local Market Insights: Eagle vs. Boise

Eagle Idaho real estate often commands premium pricing due to its lifestyle appeal. Spacious lots, master-planned communities, and proximity to the Boise River enhance desirability.

Boise Idaho, meanwhile, offers urban vibrancy, cultural amenities, and a dynamic downtown. Buyers seeking walkability may gravitate there instead.

However, both markets reward certainty. Cash offers consistently attract attention. Therefore, delayed financing for cash buyers in Eagle and Boise becomes particularly relevant in high-demand neighborhoods.

Understanding micro-market conditions is essential. For example, inventory levels in certain Eagle Idaho neighborhoods fluctuate seasonally. Monitoring data from the Idaho Housing and Finance Association can provide additional economic context.

Strategic Advantages Beyond Winning the Offer

Winning the home is only the beginning. Delayed financing also improves balance sheet flexibility. Instead of leaving substantial capital immobilized in one asset, you regain liquidity.

Moreover, this liquidity can fund renovations. Updating kitchens, landscaping, or energy systems may enhance long-term value. Alternatively, funds can support business ventures or diversified investments.

Additionally, buyers can potentially optimize tax strategies by structuring mortgage interest deductions appropriately. Consulting tax professionals is prudent. However, the optionality itself is valuable.

Working With a Local Expert Matters

Executing delayed financing for cash buyers in Eagle and Boise requires coordination. Timing is precise. Documentation must be meticulous.

As a top realtor in Eagle, Chris Budka understands how to structure competitive offers while aligning with financing timelines. Meanwhile, local lender relationships streamline the transition from cash closing to refinance.

Choosing the best realtor in Eagle ID means gaining insight into negotiation dynamics. An experienced Eagle ID realtor anticipates seller priorities and positions offers accordingly.

Furthermore, guidance doesn’t stop at closing. From market analysis to strategic positioning, comprehensive support ensures informed decisions.

Frequently Asked Questions

What is delayed financing for cash buyers in Eagle and Boise?

Delayed financing for cash buyers in Eagle and Boise allows you to purchase a home entirely with cash and then refinance shortly after closing to recover your funds. Consequently, you gain the advantage of a cash offer without permanently tying up capital.

How soon can I refinance after paying cash?

Most conventional loan programs permit refinancing immediately after closing, provided documentation requirements are met. However, lender overlays may vary. Therefore, confirming guidelines early is wise.

Can I refinance for more than I paid?

Generally, lenders cap the loan amount at the original purchase price, subject to loan-to-value limits. Even if the appraisal comes in higher, proceeds may be restricted.

Is delayed financing common in Eagle Idaho?

Yes, particularly in competitive segments of Eagle Idaho real estate. Buyers seeking homes for sale in Eagle Idaho often use this strategy to strengthen their offers.

How can Chris Budka help with delayed financing?

Chris Budka coordinates offer strategy, negotiates favorable terms, and connects clients with trusted lenders. Consequently, buyers experience a seamless transition from cash purchase to refinance.

Bottomline

Delayed financing for cash buyers in Eagle and Boise offers a sophisticated yet accessible strategy in today’s dynamic market. It empowers buyers to compete assertively, close confidently, and maintain financial flexibility. Whether targeting Eagle ID homes, relocating to Boise Idaho, or exploring the best neighborhood in Eagle, strategic execution matters.

Partnering with Chris Budka ensures clarity, confidence, and competitive positioning. Ultimately, the right strategy turns opportunity into ownership—and ownership into long-term advantage.