Equity access strategies in Eagle Idaho real estate are becoming increasingly important for homeowners who want to downsize, upgrade, or simply reposition their financial future. Over the past decade, property values across Boise Idaho and the greater Treasure Valley have appreciated significantly. Consequently, many homeowners in Eagle Idaho are sitting on substantial untapped equity. The question is no longer if you have equity. Instead, it’s how to use it wisely.

Whether you’re an empty nester ready for a simpler floor plan, a growing family seeking more square footage, or a retiree looking to optimize cash flow, understanding your options is essential. Moreover, working with a top realtor in Eagle ensures you make decisions grounded in local expertise rather than guesswork.

Let’s explore how to access your equity strategically and confidently in today’s market.

Understanding Home Equity in Eagle Idaho

Home equity is the difference between what your home is worth and what you owe on your mortgage. As Eagle Idaho real estate has matured into one of the most desirable micro-markets in the Treasure Valley, homeowners have benefited from steady appreciation.

For example, if your home is valued at $900,000 and your remaining mortgage balance is $400,000, you potentially have $500,000 in equity. That’s significant leverage.

Additionally, demand in many Eagle Idaho neighborhoods remains strong due to lifestyle appeal, proximity to recreation, and overall quality of life. According to the U.S. Census Bureau, Eagle continues to experience steady population growth. Therefore, housing demand continues to support long-term property values.

Understanding your equity position is the first step in applying effective equity access strategies in Eagle Idaho real estate.

Option 1: Selling and Downsizing

Sometimes the most straightforward strategy is also the most powerful. Selling your current home allows you to unlock equity in a lump sum. Subsequently, you can purchase a smaller home outright or significantly reduce your mortgage obligation.

Many homeowners considering downsizing explore homes for sale in Eagle Idaho to remain close to friends, amenities, and familiar surroundings. Others look toward nearby communities in the Treasure Valley.

Downsizing can provide:

-

Lower monthly expenses

-

Reduced maintenance

-

Increased liquidity

-

Greater lifestyle flexibility

Meanwhile, if you’re targeting the best neighborhood in Eagle, strategic pricing and negotiation become critical. Working with a best realtor in Eagle ID helps ensure you maximize proceeds while positioning your next purchase competitively.

Ultimately, selling is often the cleanest method of implementing equity access strategies in Eagle Idaho real estate.

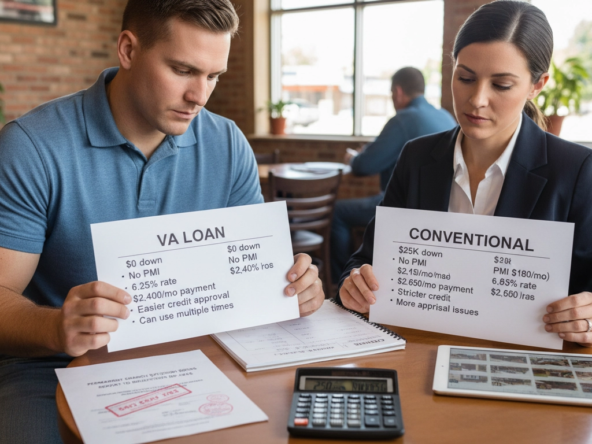

Option 2: Cash-Out Refinance

A cash-out refinance replaces your current mortgage with a larger loan, allowing you to receive the difference in cash. This strategy works particularly well if interest rates remain favorable relative to your existing mortgage.

For instance, you might refinance a $400,000 balance into a $550,000 mortgage and receive $150,000 in liquid funds. Consequently, you can use that capital for renovations, investments, or purchasing another property.

However, refinancing is not without nuance. Loan terms, interest rates, and closing costs must be evaluated carefully. Additionally, your long-term financial objectives should guide your decision.

This method is especially useful if you want to upgrade your current Eagle ID homes rather than move. Instead of relocating, you leverage equity to modernize kitchens, enhance outdoor living spaces, or add square footage.

Option 3: Home Equity Loan or HELOC

Another viable pathway involves borrowing against your equity while keeping your existing mortgage intact.

A home equity loan provides a lump sum at a fixed interest rate. In contrast, a HELOC (Home Equity Line of Credit) offers revolving access over a set timeframe.

These options can fund:

-

Major remodels

-

Investment property purchases

-

Debt consolidation

-

Education expenses

Nevertheless, borrowing against your home introduces repayment obligations. Therefore, conservative planning is key.

Before pursuing this route, review lending standards through reputable sources such as the Consumer Financial Protection Bureau. Understanding loan terms prevents unintended financial strain.

When executed responsibly, these tools support effective equity access strategies in Eagle Idaho real estate without requiring a sale.

Option 4: Strategic Renovation Before Selling

Sometimes, the smartest move is to invest before you exit.

Targeted renovations can increase resale value and amplify the equity you ultimately unlock. For example:

-

Updating kitchens with contemporary finishes

-

Refreshing primary bathrooms

-

Improving energy efficiency

-

Enhancing curb appeal

According to the National Association of Realtors, certain home improvements consistently deliver strong returns.

However, not every upgrade yields equal value. Therefore, consult a knowledgeable Eagle ID realtor before committing funds. Strategic improvements in the right Eagle Idaho neighborhood can significantly influence buyer perception and final sale price.

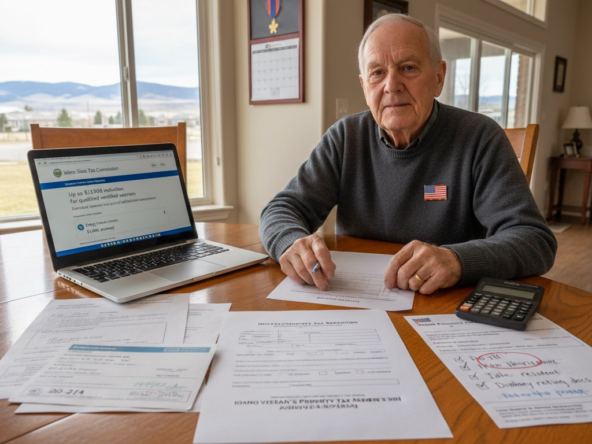

Option 5: Reverse Mortgage for Eligible Homeowners

For homeowners aged 62 and older, a reverse mortgage may provide supplemental income without monthly mortgage payments.

Instead of paying the lender, the lender pays you—either as a lump sum or structured payments. The loan is repaid when the home is sold.

This strategy can work well for retirees who wish to remain in place. However, it requires careful financial analysis and family discussions. Transparency and professional guidance are essential.

Market Timing and Local Dynamics

Equity access strategies in Eagle Idaho real estate must align with market conditions. Inventory levels, buyer demand, and interest rates all influence outcomes.

For example, during low inventory cycles, sellers often achieve stronger pricing power. Meanwhile, in balanced markets, strategic staging and pricing become even more important.

Eagle Idaho remains highly desirable due to:

-

Scenic foothills

-

Boise River access

-

Proximity to downtown Boise

-

Community-centric neighborhoods

If you’re contemplating moving to Idaho from out of state, reviewing data from the State of Idaho Official Website can provide insight into economic growth and migration trends.

Understanding local velocity and absorption rates ensures your strategy reflects real-time conditions rather than outdated assumptions.

Financial Preparation Before Accessing Equity

Preparation reduces risk. Before implementing equity access strategies in Eagle Idaho real estate, consider the following:

-

Obtain a professional home valuation.

-

Review your credit profile.

-

Calculate long-term affordability.

-

Consult financial and tax professionals.

-

Define your ultimate objective clearly.

Clarity creates confidence. Moreover, a thorough plan prevents reactive decision-making.

Why Local Expertise Matters

Real estate is hyper-local. What works in one Eagle Idaho neighborhood may not apply in another.

A seasoned Eagle ID realtor understands:

-

Buyer psychology

-

Micro-market pricing

-

Negotiation leverage

-

Marketing precision

-

Off-market opportunities

Additionally, local expertise ensures you don’t leave money on the table. Precision pricing and strategic exposure often mean the difference between average results and exceptional ones.

When homeowners ask how to optimize equity access strategies in Eagle Idaho real estate, the answer always begins with informed guidance.

Frequently Asked Questions

How do I determine my current home value in Eagle Idaho?

A professional comparative market analysis provides the most accurate estimate. Additionally, recent sales data within your Eagle Idaho neighborhood offers valuable context. An experienced agent can interpret this data strategically.

Is downsizing always the best way to access equity?

Not necessarily. While selling often unlocks the largest lump sum, refinancing or using a HELOC may align better with your long-term goals. Therefore, your strategy should reflect your lifestyle objectives.

Are there tax implications when accessing home equity?

Yes, potentially. For example, selling may involve capital gains considerations, although primary residence exemptions often apply. Consulting a tax professional ensures clarity before proceeding.

Should I renovate before listing my home?

It depends on condition and competition. In many cases, minor updates yield strong returns. However, over-improving beyond neighborhood standards can limit ROI.

How can Chris Budka Real Estate help?

Chris Budka Real Estate provides strategic guidance tailored to your goals. From valuation to negotiation, every step is handled with professionalism and precision. Whether you’re buying a home in Eagle or planning to sell your home, expert representation ensures optimal outcomes.

Bottomline

Equity is more than a number on paper. It represents opportunity.

When leveraged thoughtfully, equity access strategies in Eagle Idaho real estate can fund your next chapter—whether that means downsizing, upgrading, or repositioning your financial future. However, strategy matters. Timing matters. Guidance matters.

If you’re ready to explore your options, a clear plan backed by local expertise will position you for success. The next move should feel intentional, not uncertain. With the right approach, your equity becomes a catalyst—not just capital.