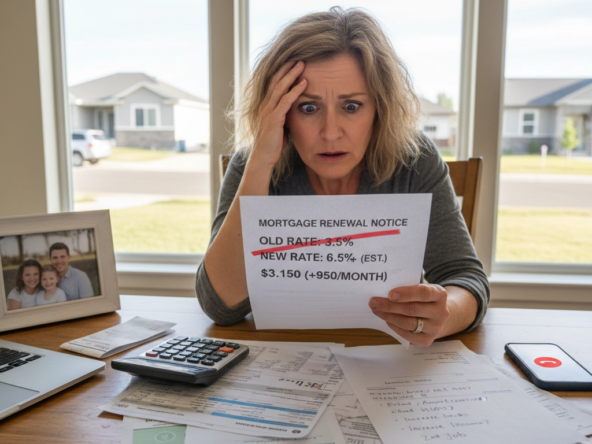

For many homeowners in Eagle Idaho, the moment of mortgage renewal can bring unwelcome surprises. A mortgage renewal shock occurs when your lender offers a new interest rate that is significantly higher than your previous rate, often after several years of lower rates. Homeowners who are unprepared can see their monthly payments spike, sometimes by hundreds of dollars, leading to financial strain. Knowing how to handle mortgage renewal shocks in Eagle Idaho can save you stress, money, and even protect your home investment.

Why Mortgage Renewal Shocks Happen

Mortgage renewal shocks usually happen due to a combination of rising interest rates, changes in your personal financial situation, and sometimes, lender tactics. For example, if your mortgage term is ending while national rates have climbed, your lender may offer a renewal at a much higher rate than your original loan. Additionally, failing to shop around or negotiate can leave homeowners stuck with rates that don’t reflect their creditworthiness or market conditions. In Eagle Idaho, where home values are climbing, the stakes are even higher for homeowners who want to maintain financial stability.

Signs You Might Face a Mortgage Renewal Shock

There are several indicators that a mortgage renewal shock may be imminent:

-

Rising interest rates nationally or regionally – Keep an eye on Federal Reserve announcements and local market trends.

-

Your fixed-rate term is ending – If your term expires during a period of high interest rates, renewal rates can spike.

-

Changes in your credit score or debt load – Lenders reassess your profile at renewal.

-

Limited lender communication – If your lender isn’t proactive in discussing options, you may face higher rates by default.

Being aware of these warning signs can help you prepare and mitigate the shock.

How to Prepare Before Renewal

Preparation is key to avoiding a mortgage renewal shock. Start by reviewing your current mortgage details well before the renewal date. Analyze your payment history, remaining balance, and remaining term. Additionally, consider consulting a local Eagle Idaho realtor or mortgage advisor who can help you understand your options.

It’s also smart to:

-

Compare rates from multiple lenders – Even if you’ve been with the same bank for years, competition can save you hundreds.

-

Check your credit score – A higher score can leverage lower rates.

-

Assess your financial goals – Whether you plan to downsize, refinance, or pay off the mortgage faster, knowing your goals informs your renewal strategy.

Negotiating Your Renewal Terms

When negotiating your mortgage renewal, don’t accept the first offer blindly. Lenders expect negotiation. Strategies include:

-

Requesting rate matching – If competitors offer lower rates, your lender may match or beat them.

-

Changing your term length – Adjusting from a 5-year to a 3-year term may lower your rate.

-

Exploring different amortization schedules – Shorter amortization periods often reduce overall interest paid.

In Eagle Idaho, working with a top realtor in Eagle can help you access local insights and lender connections you might not find online.

Considering Refinancing Instead

Sometimes, renewing with the same lender isn’t the best solution. Refinancing can be a more flexible option, especially if mortgage renewal shocks are steep. Refinancing allows you to:

-

Lock in a lower rate with another lender

-

Consolidate debt

-

Switch from a variable to a fixed-rate mortgage

It’s important to weigh the costs of refinancing against potential savings. For homeowners in Eagle Idaho, the real estate market continues to grow, meaning a smart refinance could also free up capital for other investments.

Government and Local Programs to Reduce Risk

Several local and federal programs can help mitigate mortgage renewal shocks. For example, Idaho residents can explore:

-

Idaho Housing and Finance Association programs – Assistance for refinancing and rate reduction

-

Federal mortgage relief programs – Available to certain qualified homeowners facing financial hardship

-

Local Eagle Idaho resources – Including workshops on homeownership and financial planning

Staying informed about these options can provide a safety net during stressful renewals.

Tips to Avoid Renewal Shocks Long-Term

Long-term strategies are essential for preventing future mortgage shocks:

-

Start planning early – Begin assessing your renewal at least six months prior.

-

Track interest rates – Use tools like Bankrate to monitor trends.

-

Maintain a strong credit profile – Pay bills on time, reduce debt, and avoid new loans before renewal.

-

Work with professionals – A best realtor in Eagle ID can provide insights on refinancing, home equity, or even moving options.

-

Consider alternative payment strategies – Bi-weekly payments or lump sum contributions can reduce principal and future shock risk.

When to Seek Expert Guidance

A mortgage renewal shock can be overwhelming, but you don’t have to navigate it alone. Homeowners in Eagle Idaho often benefit from working with an experienced Eagle ID realtor like Chris Budka, who can guide you through options, local lender deals, and long-term financial strategies. Additionally, mortgage advisors and financial planners can provide detailed rate comparisons and stress-test your budget.

Bottomline

Mortgage renewal shocks in Eagle Idaho don’t have to catch you off guard. By planning early, monitoring rates, negotiating your terms, and consulting experts, you can maintain control over your finances. Whether you choose to refinance, renegotiate, or explore other options, taking proactive steps ensures your home remains a source of security rather than stress.

FAQs

What is a mortgage renewal shock?

A mortgage renewal shock occurs when your lender offers a significantly higher interest rate at the time of renewal, leading to a jump in monthly payments.

How can I avoid a mortgage renewal shock in Eagle Idaho?

Start planning six months before renewal, compare rates from multiple lenders, maintain a strong credit score, and consult local experts like a top realtor in Eagle.

Should I refinance to avoid renewal shocks?

Refinancing can be an effective strategy if you find a lower rate, want to adjust term length, or consolidate debt. Always weigh costs versus potential savings.

Are there local programs in Eagle Idaho to help homeowners?

Yes, programs through the Idaho Housing and Finance Association and other federal initiatives can assist with refinancing and reducing monthly payments.

How can a realtor help with mortgage renewal shocks?

An experienced Eagle Idaho realtor like Chris Budka can guide you on local lender options, refinancing strategies, and long-term homeownership planning.