If you’re searching for how to qualify for a Veteran property tax reduction in Eagle Idaho, you’re not alone. Many military families buying or owning Eagle ID homes don’t realize they may be eligible for meaningful savings. Fortunately, Idaho offers powerful property tax relief programs specifically for qualified veterans. As a top realtor in Eagle, Chris Budka regularly helps veterans understand how these programs work — especially when purchasing or evaluating Eagle Idaho real estate.

Property taxes matter. They affect affordability, long-term budgeting, and even resale strategy. Therefore, understanding how to reduce them is essential for veterans who call Eagle Idaho home.

Understanding Veteran Property Tax Reduction in Eagle Idaho

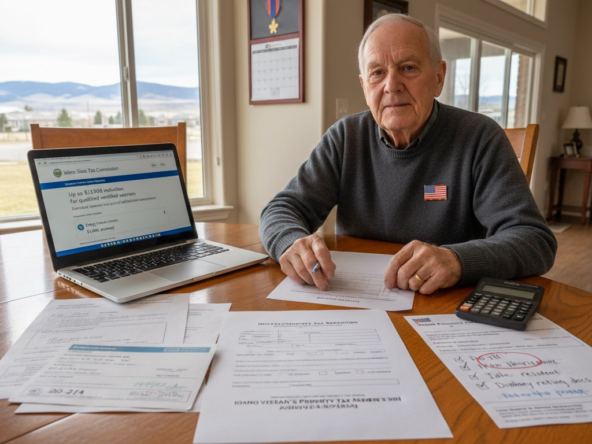

The state of Idaho offers a property tax benefit for qualified veterans with service-connected disabilities. Specifically, veterans with a 100% service-connected disability — or those receiving Individual Unemployability benefits — may qualify for up to $1,500 off their annual property tax bill.

Importantly, this Veteran property tax reduction in Eagle Idaho applies to your primary residence and up to one acre of land. However, it does not apply to secondary homes, investment properties, or additional acreage.

Because Eagle sits within Ada County, applications are processed through the county assessor. You can learn more about official state guidelines through the Idaho State Tax Commission.

Additionally, this benefit has no income limit. That alone makes it especially attractive for retired military families who may have pensions or dual incomes.

Eligibility Requirements Veterans Must Meet

Not every veteran automatically qualifies. Instead, specific criteria must be satisfied.

First, you must own and occupy the property as your primary residence by April 15 of the application year. Secondly, you must have a current Homeowner’s Exemption on file. Without it, you cannot receive the disabled veteran benefit.

Moreover, you must provide official documentation from the VA confirming your disability status. This letter typically states your rating percentage or confirms 100% compensation due to unemployability.

Veterans who qualify as permanently and totally disabled may not need to reapply annually. However, others must submit updated paperwork each year.

For additional state veteran resources, visit the Idaho Division of Veterans Services.

The Homeowner’s Exemption: A Critical First Step

Before qualifying for a Veteran property tax reduction in Eagle Idaho, you must have the Idaho Homeowner’s Exemption in place.

This exemption reduces the taxable value of your primary residence by up to 50%, capped at a state-determined amount. Therefore, it significantly lowers your baseline tax obligation.

You can review details through the Ada County Assessor’s Office.

Because property values in Eagle Idaho real estate have appreciated steadily over the past several years, exemptions matter more than ever. Consequently, filing properly ensures you are not overpaying.

The Circuit Breaker Program: Additional Relief for Veterans

In addition to the disabled veteran benefit, some veterans may qualify for Idaho’s Property Tax Reduction program, often called the Circuit Breaker.

This program is income-based and designed for qualifying low-income homeowners. While not exclusive to veterans, it can be layered with other exemptions in certain circumstances.

Income thresholds adjust annually. Therefore, checking updated limits is critical. Details are available through the Idaho State Tax Commission Property Tax Reduction page.

For veterans on fixed incomes, this program can create additional breathing room in their housing budget.

Why Property Taxes Matter in Eagle Idaho

Eagle is widely considered one of the most desirable communities in the Treasure Valley. With scenic foothills, river access, and refined master-planned communities, it attracts retirees, professionals, and relocating families.

You can explore community insights via the official City of Eagle, ID website.

However, rising home values also mean rising assessments. According to regional housing data from Realtor.com, median prices in Eagle remain among the highest in Ada County.

Therefore, securing a Veteran property tax reduction in Eagle Idaho becomes even more valuable over time.

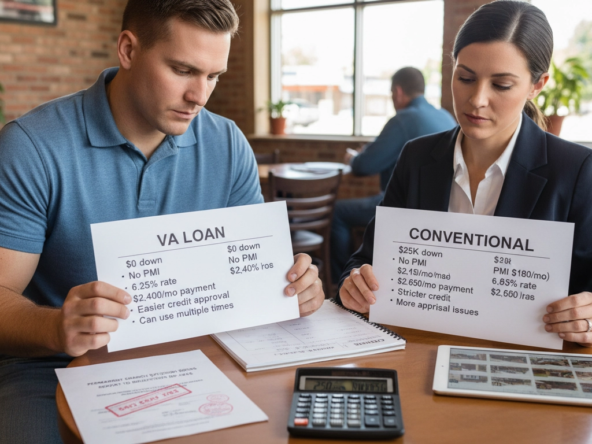

Buying Eagle ID Homes as a Veteran

If you are purchasing Eagle ID homes for sale, it’s wise to factor property tax benefits into your affordability analysis.

Working with a knowledgeable best realtor in Eagle ID ensures you understand both purchase price and long-term ownership costs.

When evaluating Eagle Idaho homes for sale, veterans should:

-

Confirm tax estimates with the county

-

File the Homeowner’s Exemption immediately after closing

-

Submit veteran documentation before April 15

Additionally, veterans relocating and moving to Idaho should establish residency promptly to avoid missing eligibility deadlines.

Choosing the Best Neighborhood in Eagle

Not all areas of Eagle are taxed equally. In fact, specific levies may vary depending on district boundaries, school zones, and special assessments.

If you’re researching the best neighborhood in Eagle, consider both lifestyle fit and tax implications.

Master-planned communities may include HOA dues. Meanwhile, rural properties may have irrigation or supplemental levies.

Understanding these nuances protects your long-term financial position.

Selling and Reapplying: What Veterans Should Know

If you sell your home and purchase another property in Eagle, you must reapply for exemptions on the new residence.

The benefit does not automatically transfer. Therefore, timing matters.

When working with Chris Budka Real Estate, veterans receive guidance on both the sale and repurchase process. That includes ensuring exemptions are re-established correctly.

For those considering whether now is the right time to sell, requesting a professional market analysis can clarify your equity position.

How Chris Budka Supports Veteran Clients

Veterans deserve clarity, not confusion. As an experienced Eagle ID realtor, Chris Budka helps military families navigate every step — from financing options to tax planning considerations.

Clients appreciate a consultative approach. Questions are welcomed. Details are explained. Deadlines are tracked.

Because Eagle remains one of the most competitive micro-markets in the Treasure Valley, preparation is vital. Ultimately, combining strong negotiation skills with tax knowledge protects your investment.

Frequently Asked Questions

Who qualifies for the Veteran property tax reduction in Eagle Idaho?

Veterans with a 100% service-connected disability or those receiving 100% compensation due to unemployability may qualify. The home must be your primary residence in Eagle, and you must file before April 15.

Can I combine the veteran benefit with other Idaho tax programs?

In some cases, yes. For example, you may qualify for the Circuit Breaker program if you meet income requirements. However, total benefits cannot exceed your tax liability.

Do I need to reapply every year?

If you are classified as permanently and totally disabled, you may not need to reapply annually. Otherwise, updated VA documentation is typically required each year.

Does this benefit apply to all Eagle ID homes?

No. The benefit applies only to your primary residence and up to one acre. Rental properties and vacation homes do not qualify.

How can Chris Budka help veteran homebuyers?

Chris provides expert guidance on Eagle Idaho real estate, exemption filings, relocation planning, and negotiations. As a trusted local advisor, he ensures veterans make informed decisions in a competitive market.

Bottomline

Owning property in Eagle is both a privilege and a strategic investment. Fortunately, the Veteran property tax reduction in Eagle Idaho offers meaningful financial relief for those who have served. By filing the correct exemptions, meeting deadlines, and working with a knowledgeable local expert, veterans can reduce expenses while building long-term equity.

If you’re exploring homes for sale in Eagle Idaho or evaluating your current property tax situation, now is the time to act. Proper guidance makes all the difference — and strategic planning today protects your tomorrow.