Eagle sellers offer credits or price cuts in 2026 — that’s the pivotal question many homeowners in Eagle, Idaho are asking as local market dynamics shift. With changing supply, shifting buyer demand, and interest rates that still influence purchasing power, homeowners preparing to sell must carefully strategize. The choice between offering seller credits versus reducing the asking price can significantly impact how fast your home sells and how much you ultimately net from the sale.

In a market as desirable as Eagle Idaho real estate — with its scenic neighborhoods, excellent schools, and vibrant community — the answer isn’t one-size-fits-all. However, understanding the pros and cons of each tactic, especially in today’s 2026 landscape, can position you to make an informed decision that attracts buyers and maximizes your return.

Understanding the 2026 Eagle Idaho Market Conditions

In 2026, the housing market across the Treasure Valley area, including Boise Idaho and Eagle, remains active, though it has normalized compared to the frenzied conditions seen in prior years. Interest rates have stabilized, and buyers are more price-conscious than in the past. According to recent industry trends from the National Association of Realtors® (NAR), buyers today seek not only value but flexibility and certainty in their transactions. Moreover, the U.S. Census Bureau confirms that population growth in Idaho continues to outpace many other states, fueling consistent housing demand over the long term.

That being said, market conditions vary street by street. In competitive segments — particularly desirable Eagle Idaho neighborhoods — sellers might still see multiple offers and faster sales. Conversely, in segments where inventory has increased or buyer demand has softened, incentives may be necessary to keep buyer interest high.

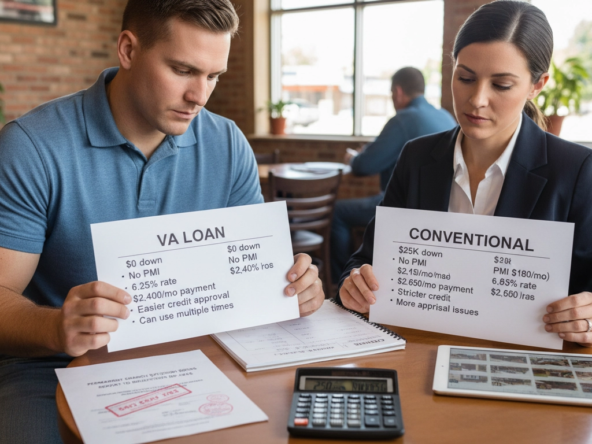

Price Cuts vs. Seller Credits — What’s the Difference?

Before deciding which strategy to adopt, it’s vital to understand what each tactic entails and how buyers perceive them.

Price Cuts:

A price reduction lowers the list price of your home. It directly impacts the perceived value and the price stamped on MLS and marketing materials. For example, reducing your listing from $600,000 to $580,000 signals to buyers and their agents that you are adjusting to market realities.

Seller Credits:

Seller credits are concessions offered at closing to help the buyer with closing costs, inspection repairs, or interest rate buy-downs. These credits don’t change the list price but effectively reduce the buyer’s out-of-pocket expenses. In some cases, credits can help a buyer qualify for a mortgage they otherwise wouldn’t.

Each approach has its place, and your decision should reflect your priorities, timeline, and the specifics of your Eagle ID home.

When Price Cuts Make Sense

There are scenarios when a price cut is the more effective strategy:

1. The Home Is Sitting on the Market Too Long:

If your home has lingered without offers, potential buyers (and agents) may perceive it as overpriced. Price cuts can reinvigorate interest and bring your listing back into buyer consideration.

2. Appraisal Concerns:

Even in a stable market, appraisals sometimes come in below contract price. A modest price reduction upfront can help align expectations and reduce appraisal-related renegotiations.

3. Broadening Buyer Pool:

A lower price can attract more buyers, including those on the fence. In markets where buyers are very price-sensitive, this can be the difference between a sale and stagnation.

When Seller Credits Are Advantageous

Seller credits can be particularly persuasive in 2026 for several reasons:

1. Helping with Closing Costs:

Many buyers today are stretching to cover down payments and closing costs, especially in competitive areas like the best neighborhood in Eagle. Offering credits can make the difference in their ability to purchase.

2. Addressing Minor Repairs:

If an inspection reveals issues, offering a credit toward repairs can keep the deal moving without the seller having to coordinate and pay for work upfront.

3. Interest Rate Buy-Down Options:

With interest rates still a consideration for buyers, offering seller credits to buy down the rate for the first few years can make your home financially accessible to more buyers.

How Buyers View Each Option

Perception plays a huge role in real estate. Some buyers love seeing a lower price because it feels transparent and straightforward. Others appreciate seller credits, especially if they reduce their upfront costs or give them flexibility to customize repairs later.

In Eagle ID real estate, where many buyers come from out of state and may be relocating from higher-cost markets, credits can be particularly enticing. They signal a seller willing to partner with a buyer — a thoughtful move in a community-oriented market.

Strategic Use of Price Reductions and Credits

Often, the most successful strategy isn’t choosing one over the other but combining them logically:

-

Initial Competitive Price + Credits: Price your home competitively from the start and offer a modest credit for buyers’ closing costs or rate buy-down.

-

Time-Based Adjustments: If your home isn’t generating showings after a set period (e.g., 14–21 days), reduce the price modestly.

-

Inspection-Based Credits: Rather than dropping the price after inspection concerns arise, offer a credit to address specific items. This keeps your sale price intact while resolving buyer apprehension.

Impact on Net Proceeds

It’s easy to focus on the list price, but what really matters is your net proceeds — the amount you walk away with after expenses, concessions, and taxes. For example:

-

A $10,000 price cut directly reduces your gross proceeds.

-

A $10,000 seller credit may have similar financial impact, but it can be offset in negotiation by stronger offers or shorter timelines.

Your Realtor can run a comparative analysis to determine which strategy preserves more of your equity while still attracting buyers.

Local Market Feedback: What Buyers Are Saying

In Eagle Idaho, buyer feedback often points to two dominant concerns:

-

Affordability: Buyers want a fair price relative to comparable homes in nearby Boise and Meridian.

-

Upfront Costs: Many buyers are more comfortable with a competitive list price and some assistance with closing costs.

As an Eagle ID realtor who engages with these buyers daily, I’ve seen that thoughtful concessions can often seal the deal faster than repeated price cuts.

Timing Your Strategy in 2026

Timing matters — not just whether to offer credits or reduce price, but when to do so. Market activity often peaks in spring and early summer. In these cycles:

-

Early listings should be priced to capture initial surge buyers.

-

Mid-cycle adjustments might include credits to combat slowing interest.

-

Late-season sellers may consider modest price cuts to close before the market cools.

Consulting up-to-date market trend reports and working with an expert who understands Eagle’s unique buyer profiles is crucial. Tools like the National Association of Realtors® Local Market Trends help evaluate where your segment stands.

How a Top Realtor in Eagle ID Can Help

A seasoned Eagle Idaho realtor can:

-

Interpret local data and buyer sentiment

-

Recommend strategic pricing and credit offers

-

Negotiate on your behalf for maximal value

-

Market your property to the right audience

My role is to ensure you don’t leave money on the table while selling in the most efficient way possible.

Final Recommendation: Tailored Strategies Win

There’s no one-size-fits-all answer. In 2026, both price cuts and seller credits are viable tools — but their effectiveness depends on your property, timeline, and buyer pool. Many Eagle sellers find success with a balanced approach: competitive pricing paired with thoughtful seller credits where appropriate.

FAQs

Who should offer seller credits instead of lowering the price?

Seller credits are ideal for sellers whose homes are priced competitively but need to help buyers with closing costs, inspections, or rate buy-downs without adjusting the list price.

How do price cuts affect buyer perception?

Price cuts can signal market responsiveness but can also lead buyers to wonder why the home hasn’t sold. Strategic timing and justification help avoid negative perceptions.

Can credits be used for loan interest rate buy-downs?

Yes. Seller credits can be applied to lower the buyer’s interest rate for the first few years, which can be a powerful incentive without reducing your list price.

Will offering credits reduce my net proceeds more than a price cut?

Financially, credits and price cuts can have similar impacts, but credits may provide greater psychological appeal to buyers and encourage full-price offers.

How can I decide what’s best for my Eagle ID home?

Work with a local expert who can analyze comparable sales, current demand, and buyer behavior specific to Eagle Idaho homes to tailor a strategy.

Conclusion

Deciding whether Eagle sellers should offer credits or price cuts in the 2026 market isn’t a simple binary choice. Instead, it’s about matching strategy to market conditions and buyer expectations. Whether you choose to incentivize buyers with seller credits, adjust your price, or combine both approaches, informed decisions backed by local expertise will help you achieve the best possible outcome.