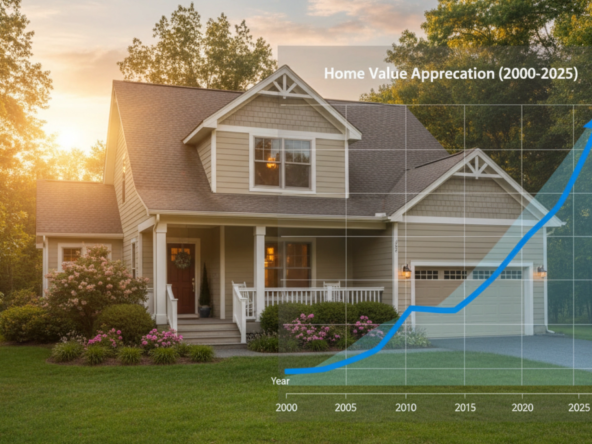

If you’re a first-time home buyer wondering how much cash you need to buy a home in Eagle, Idaho, you’re in the right place. Understanding the cash needed to buy a home in Eagle Idaho goes far beyond just the purchase price — and getting this right can boost confidence, reduce surprises, and position you for success in one of the most dynamic housing markets in the Treasure Valley.

Buying your first home is a major milestone, and preparation is key. As a top realtor in Eagle working with first-time buyers daily, I help you break down every dollar you’ll need — from your down payment to closing costs and reserves — so you step into homeownership informed and prepared.

Understanding the Basics: Purchase Price vs. Cash Needed

When budgeting for your first home, many buyers mistakenly think the cash needed to buy a home in Eagle Idaho is just the sale price. In reality, the amount of cash you need includes several components:

-

Down payment

-

Closing costs

-

Prepaid items and reserves

-

Earnest money deposit

For example, while a home may list for $500,000, your actual cash needed could range significantly depending on loan type, lender requirements, and assistance programs.

Down Payments: What First-Time Buyers Should Expect

Down payment is often the largest cash out-of-pocket expense.

For conventional loans, first-time buyers often put down 3%–5%. However, many buyers choose 10%–20% down to secure better rates and avoid private mortgage insurance (PMI). Meanwhile, FHA loans may allow as little as 3.5% down with qualifying credit history, according to the Federal Housing Administration.

Regardless of the path you take, it’s crucial to know how these percentages translate into actual cash — especially in a market where median home prices in Eagle Idaho remain higher than much of the Treasure Valley.

Closing Costs: The Hidden Cash Factor

Closing costs typically range from 2% to 5% of the purchase price. These include lender fees, title insurance, appraisal fees, prepaids, and escrow charges.

For a home priced at $500,000 in Eagle, closing costs alone could be $10,000–$25,000. That means you’ll need to have enough cash beyond your down payment to cover these fees comfortably. National averages and cost breakdowns are outlined by the National Association of Realtors.

Earnest Money and Prepaids

When you make an offer on a home, you’ll submit an earnest money deposit to show good faith. This is usually 1%–3% of the home’s price and is held in escrow until closing.

In addition, your lender may require prepaid interest, property taxes, and homeowners insurance upfront, adding to your cash-to-close total. These expenses are influenced by local property tax rates published by Idaho.gov.

Loan Program Options for First-Time Buyers

Knowing your loan options can directly influence how much cash you need.

-

FHA Loans

-

USDA Loans

-

VA Loans

-

Conventional Loans

Each program carries different requirements for cash reserves, debt-to-income ratios, and credit scores. Exploring them with an experienced lender and your Eagle ID realtor ensures you’re choosing the best path.

Grants, Assistance & First-Time Buyer Programs

Fortunately, first-time buyers in Idaho may qualify for down payment assistance programs, which can significantly reduce the cash needed to buy a home in Eagle Idaho.

These programs often offer forgivable loans or grants that can be used toward down payment or closing costs. Many options are administered statewide and explained through the Idaho Housing and Finance Association.

Cash Reserves: Why They Matter

Even after your down payment and closing costs are covered, some lenders require cash reserves — funds held after closing — to ensure you can manage future mortgage payments. These reserves may be equal to 2–6 months of principal, interest, taxes, and insurance (PITI).

Reserves offer peace of mind and strengthen your loan application, especially in competitive markets like Eagle Idaho real estate.

Example Calculation: How Much Cash a First-Time Buyer Might Need

Let’s break down a realistic scenario for a first-time buyer:

| Expense | Estimated Cost |

|---|---|

| Down Payment (5%) | $25,000 |

| Closing Costs (3%) | $15,000 |

| Earnest Money (2%) | $10,000 |

| Prepaids & Escrows | $5,000 |

| Cash Reserves | $10,000 |

| Total Cash Needed | $65,000 |

While this example varies based on price, loan program, and down payment choice, it illustrates why understanding cash needs early is critical.

Preparing Your Cash: Savings & Timing

Before making offers, begin building your savings early. Ideally, your cash cushion should exceed your estimated needs. Many first-time buyers underestimate costs or forget reserve requirements.

To strengthen your position:

-

Track income and expenses

-

Set monthly savings goals

-

Avoid new debt that could impact loan approval

How Credit Score Impacts Cash Needs

Your credit score affects your interest rate and, by extension, your overall monthly payments and cash requirements. Better scores typically result in better rates, potentially lowering your cash-to-close.

Early credit guidance can help buyers save significantly over time, especially when moving to Idaho from higher-cost states.

Working with an Eagle Idaho Realtor to Plan Your Cash

Partnering with a best realtor in Eagle ID ensures you estimate cash needs accurately. Your agent can connect you with reputable lenders, explain program qualifications, and guide you through every step of the financial process.

As you explore Eagle Idaho homes for sale, having a trusted advisor makes the experience smoother and far less stressful.

Summary: Key Cash Requirements at a Glance

Before submitting an offer, make sure you have:

-

Down payment funds

-

Closing costs

-

Earnest money deposit

-

Prepaid taxes and insurance

-

Cash reserves

Prepared buyers move faster and negotiate with confidence in Eagle’s competitive market.

Frequently Asked Questions

What is the minimum cash needed to buy a home in Eagle Idaho?

The minimum varies by loan type, but most buyers should prepare for down payment, closing costs, and reserves.

Can first-time buyers buy with no money down?

Certain loan programs allow it, depending on eligibility and property location.

Are there grants for first-time home buyers in Idaho?

Yes, state programs may reduce upfront cash requirements.

How much should I save beyond the down payment?

Plan for closing costs, prepaids, and reserves — often 5% or more.

Does my credit score affect how much cash I need?

Yes, better credit can lower rates and improve affordability.

Bottomline

Understanding the cash needed to buy a home in Eagle Idaho is essential for first-time buyers. By preparing for every financial component and working with a knowledgeable local expert, you can move forward confidently and strategically in today’s Eagle ID housing market.