TLDR

- Fixer-uppers can cost less upfront and offer equity growth with smart upgrades.

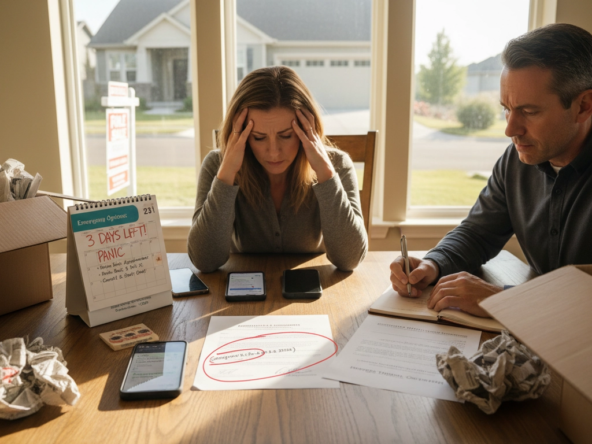

- Renovations add stress, time, and risk, so plan 10 to 20 percent contingency.

- Eagle’s market has 5 to 6 months of supply, favoring careful buyer negotiations.

- Downsizers should target single-level plans, universal design, and HOA-covered maintenance.

What does buying a fixer-upper in Eagle really mean today?

A fixer-upper in Eagle is a property priced with condition in mind that requires repairs, updates, or accessibility improvements. For many downsizers, the aim is to right-size into a lower-maintenance footprint while customizing for single-level living, safer bathrooms, and efficient systems. In today’s conditions, local MLS data shows a median sale price around 769,900 in October 2025, about 9 percent lower year over year, with a median 61 days on market and roughly 5 to 6 months of inventory. That balance generally gives buyers more leverage than we saw a couple of years ago.

Nationally, price appreciation has cooled from pandemic peaks, and long-run trends still favor quality improvements that bring homes closer to move-in ready. The FHFA House Price Index points to continued but moderating home value growth across many markets, which underscores why careful scopes, permitting, and contractor selection matter for future resale value and livability in Eagle. I cross-reference market data through the Intermountain MLS and Boise Regional REALTORS to guide timelines and offers that protect your budget and schedule.

Here is how I define it as Chris Budka:

- A fixer-upper is a home with condition-based pricing, not just a cosmetic refresh.

- The right project balances scope, budget, and resale for your neighborhood.

- Value is created by targeted upgrades that match nearby comparable sales.

How does the current Eagle market shape fixer-upper opportunities?

Eagle’s supply has expanded, with approximately 270 active listings and an estimated 5.6 months of inventory in late 2025. That level typically reflects a more balanced-to-buyer-friendly environment. Days on market around 61 indicates homes are still moving, especially when priced correctly and updated, but sellers of dated properties often negotiate on price or credits. For downsizers, this is a good window to secure a fair price and reserve funds for accessibility and efficiency upgrades.

Local trends suggest fewer multiple offers on dated listings, which reduces pressure to waive protections that matter during renovations. I rely on verified market updates from the Intermountain MLS and Boise Regional REALTORS to compare neighborhood-level pricing, days on market, and months of supply. At the national level, FHFA House Price Index trends frame how value-added renovations may appreciate over time. My advice in late 2025 is to negotiate on condition, insist on thorough inspections, and choose a scope that achieves one-level living and universal design whenever possible.

To become a smarter homebuyer, consider participating in the “Finally Home! Homebuyer Education” classes which can provide valuable insights into current housing opportunities.

What does this mean for downsizers specifically?

- Expect better negotiating room on dated homes than on turnkey listings.

- Budget for accessibility features that improve safety and resale appeal.

- Use inspection findings to target seller credits that offset renovation costs.

Which Eagle neighborhoods fit downsizers considering a fixer-upper?

Eagle offers a mix of established neighborhoods and newer planned communities near my office at 408 S Eagle Rd, Suite 205, along the Eagle Road corridor. For downsizers, the sweet spot is often a ranch or main-level primary floor plan with manageable yards and HOA support.

- The Preserve

– Details: Mature trees, water features, community pool, and proximity to Downtown Eagle and the Boise River. Many homes built during periods where original finishes may now be dated. – Watchouts: Confirm irrigation, pond, and HOA responsibilities. Inspect for roof age, window efficiency, and HVAC lifespan. – Typical timeline: Cosmetic updates 4 to 8 weeks. Kitchen and bath remodels 8 to 16 weeks.

- Renovare

– Details: Modern, low-maintenance living with community amenities like a clubhouse and pool, often appealing for Downsizing and lock-and-leave lifestyles. – Watchouts: HOA standards for exterior changes and accessibility modifications. Verify HOA coverage relative to dues. – Entry-level path: Smaller floor plans or semi-updated homes that need accessibility tweaks rather than full gut remodels.

- Foxtail Estates

– Details: Lakes, walking paths, and a park-style golf-adjacent setting. Buyers find both patio homes and larger residences. – Watchouts: Look for original builder finishes that may need updates to appliances, counters, or flooring. Verify path and lake proximity for noise during events. – Typical timeline: Flooring and paint 2 to 4 weeks. Kitchen-bath pair 10 to 14 weeks.

- Laguna Pointe

– Details: Gated waterfront luxury with private water access and trails. Great for lifestyle amenities close to Eagle’s core. – Watchouts: Waterfront exposure requires attention to drainage, exterior materials, and insurance. Permitting can be more involved for exterior changes. – Entry-level path: Focus on interior modernization and accessibility inside existing footprints.

- Infill opportunities near Downtown Eagle

– Details: Walkable access to markets, restaurants, and the Greenbelt, ideal for those moving to Eagle Idaho who value amenities nearby. – Watchouts: Older systems and smaller lots can limit additions. Check City of Eagle guidelines for setbacks and historic character. – Typical timeline: Permits 3 to 8 weeks depending on scope. Interior updates 8 to 20 weeks.

For broader planning and permitting resources, visit the City of Eagle Community Development. For school info that can influence resale, see the West Ada School District. For lifestyle, Eagle Island State Park and the Greenbelt increase walkability and recreation, both of which support long-term resale and quality of life.

What are the pros and cons of buying a fixer-upper in Eagle?

Pros:

- Lower purchase price: Dated homes often list 5 to 15 percent under updated comparables, preserving renovation budget.

- Less competition: Turnkey-focused buyers tend to pass, increasing negotiation leverage and inspection protections.

- Equity potential: Strategic upgrades that match neighborhood values can boost resale over 12 to 36 months.

- Customization: Tailor one-level living and accessible baths that support safe aging in place.

- Maintenance reset: New roof, HVAC, and windows can reduce surprises for 10 to 20 years.

Cons:

- Hidden costs: Mold, foundation, or electrical issues can add 10 to 20 percent to budgets.

- Time and stress: Contractors, permits, and supply lead times can stretch timelines well beyond estimates.

- Financing complexity: Renovation loans carry extra documentation, inspections, and fees.

- Over-improvement risk: Spending beyond neighborhood norms can cap ROI at resale.

How do I budget, finance, and plan renovations as a downsizer?

Start with a clear scope. For many Eagle ID homes for sale that need love, the best first dollars go to safety and systems. Think electrical panels, roof life, HVAC efficiency, and plumbing. Then prioritize accessibility and livability upgrades. In my experience, typical local cost ranges look like this, depending on size and finish level:

- Roof replacement: 12,000 to 20,000

- HVAC replacement: 8,000 to 15,000

- Window package: 15,000 to 35,000

- Kitchen remodel: 25,000 to 60,000

- Full bath remodel with accessibility: 12,000 to 30,000

- Flooring and paint package: 8 to 12 per square foot combined

- Accessibility items: 1,500 to 8,000 for grab bars, zero-threshold shower, wider doorways

Build a 10 to 20 percent contingency into every budget. Use a pre-inspection to uncover likely surprises. For financing, discuss renovation loans like FHA 203(k), which roll purchase and repair costs into one mortgage. Review requirements directly from HUD on 203(k) and compare with conventional renovation options. Downsizers sometimes pair proceeds from a sale with a smaller mortgage to keep monthly expenses lean.

One of my clients bought a 1990s single-level in The Preserve that needed systems updates and bath accessibility. We negotiated 12,000 in seller credits after inspection and completed a 14-week scope. With a new roof, updated HVAC, a zero-threshold shower, and quartz counters, their energy bills dropped, daily living got safer, and the home appraised 8 percent higher than purchase plus renovation costs.

Another client relocating and Moving to Eagle Idaho targeted a patio home in Foxtail Estates. It needed only medium updates. We phased the work: immediate bath safety and flooring in 4 weeks, then a kitchen refresh after move-in. Phasing cut stress, preserved cash, and avoided temporary housing. They now enjoy the trails and nearby amenities, plus a maintenance plan aligned with the HOA.

How to structure your plan for success

- Start with inspections, contractor walk-throughs, and two bids per trade.

- Align upgrades with neighborhood comps from Intermountain MLS.

- Confirm permit needs with the City of Eagle early to prevent delays.

- Prioritize universal design for long-term livability and resale.

- Build in a realistic timeline buffer of 2 to 6 weeks.

For community and senior resources that support Downsizing, connect with the Eagle Senior Center, the Idaho Commission on Aging, and Area 3 Agency on Aging. My team at Chris Budka Real Estate also maintains a vetted list of local contractors and accessibility specialists.

FAQs

1) How competitive are offers on fixer-uppers right now? With roughly 5 to 6 months of supply and median days on market near 61, dated homes usually face less competition than turnkey listings. You still need strong terms, but you can often retain inspection, financing, and appraisal protections. The key is pricing the renovation risk accurately and using MLS comps to justify credits or price adjustments based on condition.

2) What are the best upgrades for resale in Eagle? Safety and systems first. Replacing aged roofs, HVAC, and windows delivers buyer confidence and energy savings. Next, focus on kitchens and primary baths with timeless finishes. Universal design features like curbless showers, wider doorways, and lever handles perform well among Eagle’s move-up and downsizing buyers. Avoid overly personalized finishes that limit your buyer pool at resale.

3) How long do permits take in Eagle? Timelines vary by scope and season. Plan 3 to 8 weeks for many residential permits, plus additional time for engineering on structural changes or waterfront adjacency. Start early with the City of Eagle Community Development and build a 2 to 6 week buffer into your schedule. Experienced contractors help preempt issues with complete submittals and correct inspections.

4) Should I use a renovation loan or pay cash for improvements? If you prefer to preserve cash, renovation loans like FHA 203(k) or conventional rehab options can be helpful. They add documentation and inspection steps that lengthen timelines but can lower out-of-pocket costs. If you have significant equity from a sale, cash can shorten timelines and reduce interest. Compare total carrying costs and consult your lender and tax advisor.

5) How do I avoid over-improving for the neighborhood? Use neighborhood-specific MLS comparables and a clear after-renovation value target. Align finish levels and features with the top 20 percent of nearby sales, not custom luxury beyond the area’s ceiling. I provide a room-by-room scope with cost ranges and projected ROI so you can choose upgrades that keep you inside neighborhood norms and protect resale.

6) What if inspections uncover major issues after I am under contract? This is where offer protections matter. You can negotiate a seller credit, request repairs, adjust the price, or cancel within your contingency timelines. I coordinate trade-specific bids quickly so you understand the financial impact. If the discovery pushes the project beyond your comfort zone, we pivot to a better fit without sacrificing your goals.

7) Are HOA communities better for downsizers doing renovations? Often yes, since exterior maintenance may be covered and yards are smaller. Confirm HOA rules for exterior changes, accessibility modifications, and construction hours. Review CC&Rs and budget reserves to gauge the community’s financial health. The right HOA can reduce long-term maintenance and support lock-and-leave living without limiting your essential interior upgrades.

Conclusion

The bottom line Buying a fixer-upper in Eagle can be a smart path for downsizers who want equity upside, single-level living, and tailored accessibility. Today’s inventory and days-on-market trends provide room to negotiate, but success depends on disciplined budgeting, realistic timelines, and neighborhood-aligned scopes. Start with inspections, prioritize systems and safety, and phase cosmetic work to reduce stress. As the best Eagle Idaho realtor to guide seasoned and first-time remodelers alike, I help you identify the right property, secure fair credits, and assemble a reliable team so your new home delivers comfort, value, and lasting peace of mind.