Relocating to Eagle is exciting, and the homeowner tax exemption in Eagle Idaho is one of the most impactful financial benefits new residents can take advantage of immediately. This exemption can substantially reduce your taxable home value, which helps lower your annual property tax bill. As you explore Eagle Idaho real estate, understanding how this exemption works can significantly influence your budgeting, purchasing decisions, and long-term planning.

Eagle remains one of the most desirable communities in the Treasure Valley, offering scenic neighborhoods, strong property values, and a vibrant lifestyle. Additionally, Idaho’s homeowner tax exemption makes settling here even more financially attractive for homeowners, retirees, and relocating families.

What Makes the Idaho Homeowner Tax Exemption Valuable for Eagle Residents?

The exemption removes 50% of the assessed value of your primary residence—up to a state-set maximum—before property taxes are calculated. Consequently, this reduces your annual tax burden and helps make homeownership in Eagle more sustainable over time.

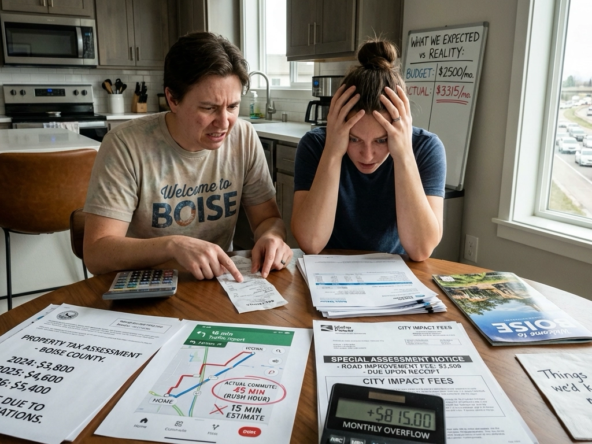

Meanwhile, many homeowners underestimate how much this exemption can save them annually. In a high-value market like Eagle, where home prices often exceed broader Treasure Valley averages, the exemption can translate into thousands of dollars in tax reductions. Moreover, the benefit applies every year as long as the home remains your primary residence.

If you’re moving to Idaho for the first time, this exemption often provides a welcome reprieve as you adjust to new expenses, utilities, and lifestyle changes.

Who Qualifies for the Exemption When Moving to Eagle?

You must own and occupy the home as your primary residence by January 1 of the year in which you’re applying. For example, if you move to Eagle in the fall, you may occupy the home but need to ensure all paperwork is filed promptly to receive the exemption for the following tax year. Again, the primary factor is residency—your Eagle home must be your predominant place of living.

Additionally, Idaho allows eligibility for outbuildings and acreage associated with your primary residence. This is especially helpful in Eagle, where larger parcels and lifestyle properties are common.

How Do New Eagle Homeowners Apply for the Tax Exemption?

The application is straightforward and handled through the Ada County Assessor’s Office. After closing on your home, you’ll complete an application that verifies ownership and occupancy. Although the process is simple, many new residents delay filing or misunderstand the January 1 deadline. Therefore, it’s essential to apply as soon as possible.

For accurate information, the Ada County Assessor provides official guidance through Idaho.gov and county resources. You can review property tax details directly through the state’s public documentation, including how exemptions affect taxable value.

How Much Can You Save as an Eagle Homeowner?

Savings depend on assessed value and local levy rates, but the homeowner tax exemption often provides meaningful annual relief. Eagle’s levy rates are influenced by Ada County, the City of Eagle, and local taxing districts. For instance, according to the City of Boise (a nearby municipality with similar tax structures), urban growth and strong market conditions continue to impact property valuations across the Treasure Valley. Consequently, your exemption can act as an important stabilizer in a fluctuating market.

Furthermore, Idaho’s steady population growth—referenced frequently through U.S. Census migration data—supports appreciating home values. As home values rise, the exemption becomes even more valuable in offsetting your tax bill.

What Makes This Exemption Especially Important in Eagle’s Market?

Eagle is known for premium neighborhoods, upscale master-planned communities, and a high quality of life. As a result, assessed home values commonly exceed the statewide average. Therefore, the homeowner tax exemption in Eagle Idaho delivers cost-saving advantages that other regions may not experience to the same degree.

For example, whether you’re searching for Eagle Idaho homes for sale or transitioning from another Idaho city such as Boise Idaho, leveraging the exemption helps balance higher market prices with consistent tax relief.

Ultimately, taking full advantage of this program contributes to long-term housing affordability. It also influences decisions about refinancing, remodeling, and home retention, especially for those aging in place or downsizing.

How Does the Exemption Affect Relocating Families and Retirees?

Relocating families benefit from predictable expenses, making budgeting easier as they settle into new routines. Meanwhile, retirees relocating to Eagle appreciate that Idaho’s property tax structure is relatively straightforward and financially favorable.

Additionally, because the exemption renews each year, it provides enduring relief without repeated filings. This ongoing benefit supports fixed-income households and helps ensure longevity in homeownership.

What Should Homebuyers Consider Before Purchasing in Eagle?

When evaluating Eagle neighborhoods, buyers should review property tax history, levy districts, and assessed values. These factors directly influence potential tax savings once the exemption is applied.

Similarly, those considering new construction should note that tax assessments may adjust as improvements are completed. The exemption will apply to the assessed value once the home is finished and occupied.

If you’re buying a home in Eagle, factoring in the homeowner exemption early can help you determine affordability and long-term financial planning.

How Can a Top Realtor Help You Navigate These Details?

A top realtor in Eagle such as Chris Budka guides clients through nuances of Idaho tax benefits, exemption timelines, and county processes. With years of expertise helping families relocate, downsize, and invest, Chris ensures you take advantage of every available benefit. You can explore more about his credentials through his profile on FastExpert.

Additionally, Chris helps you understand Eagle’s distinctive market dynamics, neighborhood property valuations, and where the exemption delivers the greatest financial advantage—especially in premium communities.

FAQs

What is required to qualify for the homeowner tax exemption in Eagle?

You must own and occupy the home as your primary residence by January 1. Proof of residency is required.

How do I apply for the exemption after my home purchase?

You’ll submit an application through the Ada County Assessor’s Office immediately after moving in.

Can I still apply if I moved to Eagle late in the year?

Yes, you can apply, but the exemption may start the following tax year depending on move-in date and paperwork timing.

Does the exemption apply to second homes or investment properties?

No, the exemption only applies to your primary residence.

How can Chris Budka Real Estate help with the process?

Chris Budka Real Estate provides guidance on timing, local tax expectations, and applying correctly to maximize your tax savings.

Bottom Line

The homeowner tax exemption in Eagle Idaho is one of the most valuable benefits available to new homeowners. By reducing your taxable property value, it creates long-term financial advantages and boosts housing affordability in one of Idaho’s most sought-after communities. Whether you’re relocating, downsizing, or searching for the best neighborhood in Eagle, understanding and securing this exemption ensures you start your life in Eagle on strong financial footing.