Buying a home is a milestone, and understanding the credit score to buy a home in Eagle Idaho is one of the most common questions buyers ask when entering the Eagle Idaho real estate market. Fortunately, the answer is more flexible than many expect. While credit plays a role, it is only one piece of a much larger puzzle. Ultimately, buyers in Eagle Idaho have several loan options, each with different credit score thresholds, advantages, and strategic considerations.

Eagle Idaho continues to attract relocating families, retirees, and young professionals drawn to its neighborhoods, lifestyle, and proximity to Boise Idaho. Therefore, understanding how lenders evaluate credit can help you position yourself competitively when pursuing Eagle Idaho homes for sale.

What Lenders Really Mean by Credit Score Requirements

When lenders talk about credit score requirements, they are assessing risk rather than passing judgment. In fact, your credit score helps lenders determine interest rates, loan programs, and approval conditions. However, it does not automatically determine whether you can buy a home.

Most lenders rely on FICO scores, which range from 300 to 850. Meanwhile, higher scores typically unlock better loan terms, while lower scores may require compensating factors. These factors can include a larger down payment, stable income, or lower overall debt.

In Eagle Idaho, buyers often work with local lenders who understand the nuances of the Treasure Valley housing landscape. Consequently, buyers may find more flexibility than they expect when working with professionals familiar with Eagle ID neighborhoods and local pricing dynamics.

Minimum Credit Score by Loan Type

Different mortgage programs come with different credit requirements. Therefore, knowing which loan fits your situation is critical.

Conventional Loans

Conventional loans are popular among buyers in Eagle Idaho, particularly those purchasing move-up homes or luxury properties. Generally, lenders require a minimum credit score of 620 for conventional financing. However, buyers with scores above 700 often secure more favorable interest rates, according to national lending data from the National Association of Realtors.

Additionally, conventional loans tend to reward financial stability. Lower debt-to-income ratios and consistent employment history can significantly strengthen an application. As a result, buyers with solid overall finances may qualify even if their credit score is closer to the minimum.

FHA Loans

FHA loans are often ideal for first-time buyers or those with moderate credit challenges. Typically, FHA financing allows credit scores as low as 580 with a 3.5% down payment. In some cases, buyers with scores between 500 and 579 may qualify with a larger down payment, as outlined by the U.S. Department of Housing and Urban Development.

Meanwhile, FHA loans can be a practical stepping stone for buyers planning to refinance later. Therefore, they remain a popular choice for those buying their first home in Eagle Idaho or transitioning into the market.

VA Loans

VA loans serve eligible veterans, active-duty service members, and certain surviving spouses. Although the VA does not set a strict minimum credit score, most lenders prefer a score around 620. Guidance from the U.S. Department of Veterans Affairs confirms that lender flexibility varies.

Notably, VA loans often require no down payment and no private mortgage insurance. Consequently, they can be an exceptional option for qualifying buyers moving to Idaho and seeking long-term affordability.

USDA Loans

USDA loans are designed for rural and suburban areas, and parts of the Treasure Valley may qualify depending on property location. Generally, lenders look for a credit score of around 640, based on program details from the USDA Rural Development.

Additionally, USDA loans offer zero-down financing and competitive interest rates. Therefore, they can be appealing for buyers prioritizing affordability while still enjoying access to Eagle Idaho amenities.

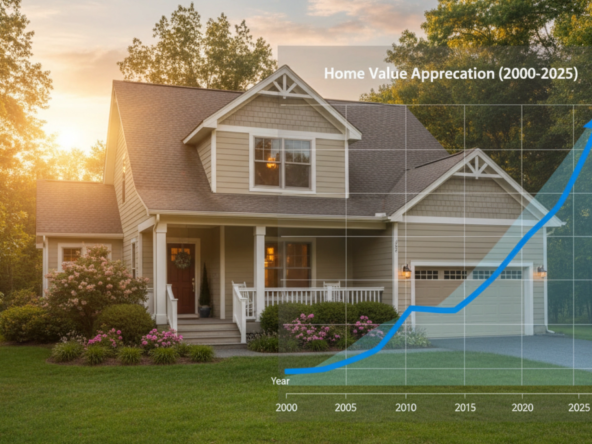

How Credit Score Impacts Your Interest Rate

While qualifying for a loan is one hurdle, your interest rate is equally important. Even small differences in interest rates can result in substantial changes to monthly payments over time.

For example, a buyer with a 760 credit score may receive a significantly lower rate than someone with a 640 score. Consequently, improving your credit before purchasing can save thousands over the life of a loan. Meanwhile, buyers with lower scores can still succeed by structuring offers strategically.

Other Factors Lenders Consider Beyond Credit

Although credit score matters, lenders also evaluate the full financial picture. Therefore, buyers should focus on these additional elements.

Debt-to-Income Ratio

Your debt-to-income ratio compares monthly debt payments to gross income. Lower ratios generally improve approval odds. In fact, many lenders prefer a DTI below 43%, although exceptions exist.

Employment Stability

Consistent employment history reassures lenders. Ideally, buyers show at least two years of stable income. However, career progression within the same field is often viewed favorably.

Down Payment

A larger down payment can offset a lower credit score. Additionally, it may reduce monthly payments and eliminate mortgage insurance on certain loans.

Why Local Market Knowledge Matters in Eagle

Eagle Idaho real estate operates differently than larger metro areas. Inventory levels, competition, and pricing trends vary by Eagle Idaho neighborhoods. Therefore, buyers benefit from working with a local expert who understands how lenders and sellers behave in this market.

As a top realtor in Eagle, guiding buyers through financing expectations is part of ensuring a smooth transaction. Meanwhile, aligning your credit profile with the right loan product can strengthen your negotiating position when making an offer.

Preparing Your Credit Before Buying

Preparation can make a significant difference. Therefore, consider taking these steps before purchasing.

First, review your credit report for errors. Incorrect information can unfairly lower your score. Next, pay down high-interest debt to improve utilization ratios. Additionally, avoid opening new credit accounts during the homebuying process.

For buyers planning to buy within six to twelve months, incremental improvements can meaningfully impact loan terms. Consequently, strategic planning often pays dividends.

How an Eagle Idaho Realtor Helps You Navigate Financing

An experienced Eagle ID realtor does more than show homes. They help coordinate with lenders, analyze affordability, and ensure your financing aligns with market conditions.

By understanding the credit score to buy a home in Eagle Idaho, buyers can approach the process with confidence rather than uncertainty. Moreover, working with the best realtor in Eagle ID ensures that financing conversations align with realistic home options and neighborhood goals.

Frequently Asked Questions

What credit score do I need to buy a home in Eagle Idaho?

Most buyers need a minimum score of 620 for conventional loans. However, FHA loans may allow scores as low as 580, depending on down payment and lender guidelines.

Can I buy a home in Eagle with bad credit?

It is possible, especially with FHA or VA loans. However, buyers may face higher interest rates or stricter conditions. Improving credit beforehand is often beneficial.

Does Eagle Idaho have special loan programs for buyers?

While Eagle follows national loan programs, local lenders may offer competitive options tailored to the Treasure Valley market. Exploring multiple lenders is recommended.

How long should I work on my credit before buying?

Many buyers see improvements within three to six months. However, timelines vary depending on debt levels and credit history.

How can Chris Budka Real Estate help me buy with confidence?

By providing local market expertise, lender connections, and negotiation strategy, Chris Budka Real Estate helps buyers align financing with the right homes and neighborhoods.

Bottom Line

Understanding the credit score to buy a home in Eagle Idaho removes unnecessary stress from the buying process. While higher credit scores unlock better terms, buyers with a wide range of scores can still succeed with the right strategy. Ultimately, preparation, local expertise, and smart financing choices make all the difference when buying in Eagle Idaho.