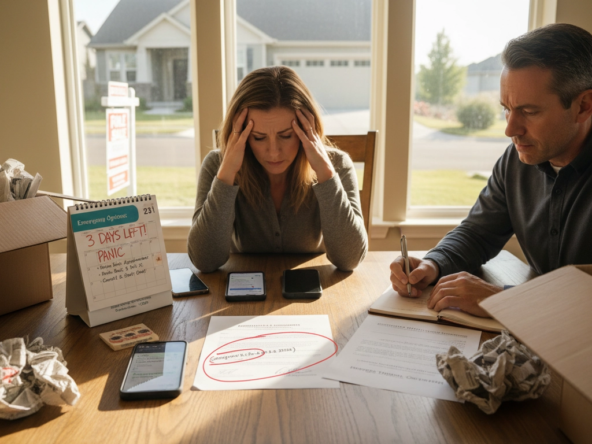

Buying a home is often one of life’s proudest milestones. However, losing your job after buying a home in Eagle Idaho can feel like the ground shifts beneath your feet. The good news is that a job loss does not automatically mean losing your home. In fact, many homeowners in Eagle Idaho, Boise Idaho, and across the Treasure Valley navigate this situation successfully with the right strategy, local insight, and timely action. Understanding your options early can protect your finances, your credit, and your long-term goals.

The Eagle Idaho real estate market has remained resilient, yet unexpected life events still happen. Therefore, knowing how to respond can make all the difference between panic and a plan.

Understanding Your Mortgage Obligations

Your mortgage does not disappear when income changes. However, lenders understand that job loss happens, particularly in evolving employment markets like Boise ID and the surrounding areas. Most mortgages include grace periods, typically 15 days, before late fees apply. Meanwhile, missing payments without communication can quickly escalate problems.

Additionally, federal regulations require lenders to work with homeowners before initiating foreclosure. According to guidance from the Consumer Financial Protection Bureau, communication is critical. Therefore, contacting your lender immediately after a job loss is not a sign of failure. Instead, it demonstrates responsibility and foresight.

Importantly, homeowners who act early often have more options available than those who wait until savings are depleted.

Assessing Your Financial Runway

Before making any decisions, take a clear look at your financial landscape. For example, calculate how many months you can cover your mortgage using savings, severance, or unemployment benefits. Idaho unemployment resources, outlined by Idaho.gov, can provide short-term assistance while you search for new work.

Additionally, review discretionary spending. Meanwhile, trimming nonessential expenses can stretch your runway significantly. Small changes add up quickly, especially in the first few months after a job loss.

Ultimately, clarity reduces fear. Once you know how much time you have, decisions become more strategic rather than reactive.

Loan Forbearance and Mortgage Relief Options

If income disruption extends beyond a few months, forbearance may be a viable solution. Forbearance allows you to pause or reduce payments temporarily. However, it is not forgiveness. The missed payments must eventually be repaid.

Most conventional loans, FHA loans, and VA loans offer forbearance options. Therefore, veterans and relocating families in Eagle ID may have additional protections. The U.S. Department of Housing and Urban Development outlines homeowner assistance programs that can help during financial hardship.

For example, repayment plans may spread missed payments over time. Alternatively, loan modifications can adjust interest rates or extend loan terms. Consequently, monthly payments may become more manageable.

Refinancing or Recasting Your Mortgage

In some cases, refinancing can reduce monthly payments, especially if interest rates are favorable. However, refinancing typically requires stable income, which may limit eligibility immediately after a job loss.

Mortgage recasting, on the other hand, allows you to make a lump-sum payment toward the principal and lower future payments. Additionally, recasting often involves lower fees than refinancing.

These options can be particularly effective for homeowners with strong equity in Eagle Idaho homes for sale in Eagle Idaho and stable long-term plans.

Exploring Rental Options for Stability

Another strategy involves converting your home into a rental property. Eagle Idaho continues to attract people moving to Idaho, which supports steady rental demand. Therefore, renting your home may cover or offset mortgage payments while you regroup professionally.

Meanwhile, some homeowners choose to rent a smaller, more affordable residence temporarily. This approach preserves ownership while improving monthly cash flow.

Before renting, review lender rules and local rental regulations. The City of Eagle provides helpful housing guidance through the Eagle, ID Official Website.

Selling as a Strategic Choice, Not a Failure

Sometimes, selling your home is the smartest move. This is especially true if the job loss is permanent or requires relocation. In fact, selling early can protect your credit and preserve equity.

The Eagle Idaho real estate market has seen consistent buyer interest, particularly among families, retirees, and young professionals. Therefore, well-priced homes often attract strong offers.

Working with a top realtor in Eagle who understands pricing, timing, and negotiation is critical. A strategic sale can create a clean financial slate and open doors to new opportunities.

Understanding Equity and Market Conditions

Equity plays a central role in decision-making. If you purchased recently, equity may be limited. However, homeowners who bought before recent appreciation cycles often have substantial equity.

Market trends in Eagle Idaho real estate continue to favor sellers in many neighborhoods. According to Realtor.com, demand in suburban Idaho markets remains strong due to lifestyle appeal and job growth.

Therefore, understanding your home value through a local market analysis provides clarity. Knowing your numbers empowers confident decisions.

Protecting Your Credit During a Job Loss

Credit protection should remain a priority. Late payments can significantly impact your score. However, lender agreements such as forbearance are typically reported as current if followed correctly.

Additionally, avoid using high-interest credit cards to cover mortgage payments long-term. Instead, focus on structured solutions that preserve financial health.

Consequently, proactive communication and documentation are your strongest allies.

How a Local Eagle Idaho Realtor Can Help

Navigating job loss while owning a home requires more than general advice. It requires local expertise. An Eagle ID realtor understands neighborhood trends, buyer behavior, and pricing nuances that national advice overlooks.

For example, certain Eagle Idaho neighborhoods sell faster than others. Meanwhile, some price points attract multiple offers even during economic uncertainty.

Working with Chris Budka Real Estate means having a trusted advocate who evaluates all options, from holding and renting to selling with confidence. This guidance is especially valuable for veterans, downsizers, and relocating families who need clarity without pressure.

Planning Ahead to Reduce Risk

While no one predicts job loss perfectly, preparation matters. Maintaining an emergency fund, avoiding over-leveraging, and choosing the best neighborhood in Eagle for long-term stability all reduce risk.

Additionally, buying within your comfort zone rather than maximum approval creates breathing room. This approach is especially important for first-time buyers and young professionals.

Ultimately, thoughtful planning transforms uncertainty into resilience.

Frequently Asked Questions

What should I do first if I lose my job after buying a home?

Contact your lender immediately, review your savings, and avoid missing payments without a plan. Early action preserves options.

Can I qualify for unemployment and still keep my home?

Yes. Unemployment benefits can help cover expenses while you explore forbearance or repayment plans.

Is selling my home quickly a bad idea?

Not necessarily. In fact, selling strategically in Eagle Idaho can protect equity and credit if income disruption is long-term.

Will losing my job automatically lead to foreclosure?

No. Foreclosure is a process, not an immediate event. Communication and proactive steps often prevent it entirely.

How can Chris Budka help during this situation?

By evaluating market conditions, equity, and personal goals, Chris Budka provides clear guidance tailored to Eagle Idaho homeowners.

Bottom Line

Losing your job after buying a home in Eagle Idaho is stressful, but it is not the end of the road. With early action, informed decisions, and local expertise, homeowners can protect their future and move forward with confidence. Whether the right path involves staying, renting, or selling, clarity and support make all the difference.