Can Retirees Downsizing in Eagle Idaho Expect Tax Differences?

TLDR Summary

Retiree downsizing taxes in Eagle Idaho vary depending on property type and timing.

Idaho property tax rules are different than many states.

Idaho has no state tax on Social Security benefits.

Capital gains taxes may apply when selling.

Local market insights show strong demand in Eagle and nearby communities.

Work with a top Eagle Idaho Realtor for a seamless transition.

What Are the Tax Implications of Downsizing in Eagle Idaho?

Retiree downsizing taxes in Eagle Idaho depend on several factors: property taxes, state income taxes, and potential capital gains when selling your home. Idaho does not tax Social Security benefits, which is a major financial advantage for retirees relocating here.

Property Taxes

Idaho’s property taxes are determined by assessed value and local levy rates, which vary by county. In Ada County, where Eagle is located, rates average around 0.69% of assessed home value—lower than the national average. That said, retirees buying a new property in Eagle should plan for reassessment based on the purchase price.

Eagle Example

If you purchase a home in Eagle at $800,000, your estimated annual property taxes would be around $5,500 (before exemptions). Idaho also offers a circuit breaker property tax reduction program for qualifying seniors, which can help lower costs.

Income Taxes

Idaho has a flat income tax rate of 5.8% (as of 2025). The good news: retirees don’t pay state tax on Social Security income. However, pensions, 401(k), and IRA distributions are taxable at the state level.

Capital Gains Taxes

When selling a home in Eagle or elsewhere in the Treasure Valley, capital gains taxes may apply. At the federal level, retirees can exclude up to $250,000 (single) or $500,000 (married) of gains from the sale of a primary residence. Idaho does not provide additional exemptions, so it’s important to plan ahead when downsizing.

Personal Insight

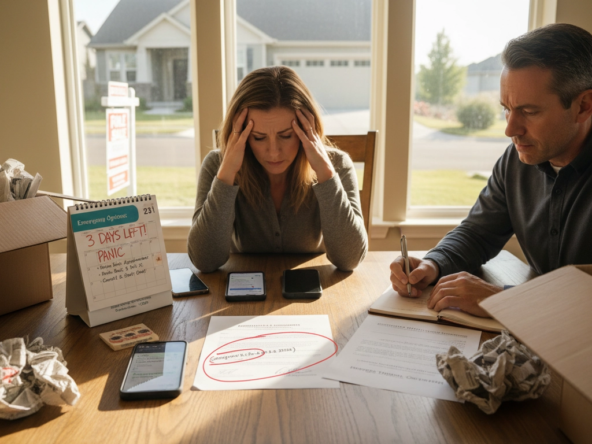

One of my clients recently sold their large Meridian home and downsized into a single-level property in Eagle. They appreciated Idaho’s no tax on Social Security benefits, but they hadn’t anticipated the reassessed property taxes on their new home. Planning early helped them budget confidently.

How Can Downsizing Affect Your Tax Situation?

Pros:

Lower maintenance costs in smaller Eagle homes.

Reduced utilities and property taxes compared to larger estates.

Potential tax savings from capital gains exclusions.

Cons:

Higher property taxes if you move into a newly built or more expensive home.

State income tax on pensions and retirement account withdrawals.

Best Areas Around Eagle for Downsizing

Eagle and the Treasure Valley offer plenty of neighborhoods ideal for retirees:

Eagle Foothills – Scenic views, single-level homes, and privacy.

Downtown Eagle – Walkable lifestyle with shops and dining.

Meridian (Settlers Bridge, Paramount) – Close to healthcare and shopping.

Star, Idaho – A quieter community with smaller, low-maintenance homes.

How Can a Top Eagle Idaho Realtor Assist in Downsizing?

Navigating retiree downsizing taxes in Eagle Idaho is just one part of the process. Working with a local expert ensures:

Accurate tax and market guidance when buying or selling.

Personalized service to match your retirement goals.

Smooth transactions with less stress and more confidence.

Client Story:

I recently helped a retired couple from California downsize into a low-maintenance home in Eagle. By leveraging capital gains exclusions and Idaho’s favorable tax laws, they secured the perfect property while reducing their monthly expenses.

FAQs

1. Are property taxes higher in Eagle Idaho compared to other states?

Idaho’s property tax rates are below the national average, but new home purchases are reassessed, which can increase costs.

2. Does Idaho tax retirement income?

Idaho does not tax Social Security benefits, but pensions and 401(k) withdrawals are taxable.

3. How do capital gains affect retirees selling in Eagle?

You may exclude $250,000 (single) or $500,000 (married) in gains on a primary residence. Gains beyond that are taxable.

4. Is Eagle Idaho a good place for retirees to downsize?

Yes, Eagle is popular for its safe neighborhoods, walkability, and access to healthcare, recreation, and dining.

5. How can a Realtor help with downsizing in Eagle?

An experienced Eagle Realtor provides area tours, market insights, and step-by-step guidance on taxes, financing, and relocation.

Conclusion

Retiree downsizing taxes in Eagle Idaho are manageable with the right planning. From property taxes to capital gains considerations, understanding these factors ensures a smooth transition. With over 23 years of experience helping families relocate and downsize in the Treasure Valley, I’m here to guide you every step of the way.

Chris Budka | Boise & Eagle Idaho Realtor

👉 Call/Text: (208)745-2895

👉 Email: [email protected]

👉 Website: https://chrisbudka.com